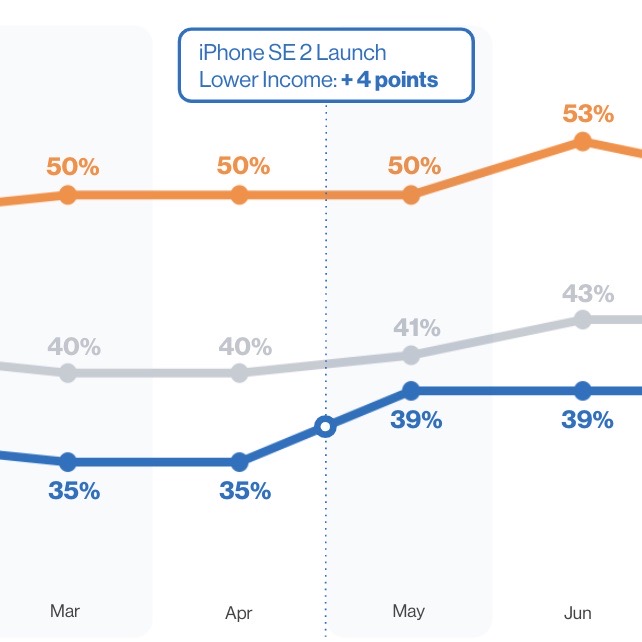

When Apple launches its annual line-up of new iPhones each Fall, it creates a surge in device adoption that spans the holiday season. Since the 2017 launch of the completely reimagined iPhone X, improvements to subsequent phones have been incremental, offering gains mainly related to the chipset, camera and screen. Since then Apple has released the iPhone XS and XR variants, the iPhone 11 line up and the 2nd Generation iPhone SE. The iPhone 12, coupled with 5G support, seems poised for stronger than usual uptake.

Flurry Blog

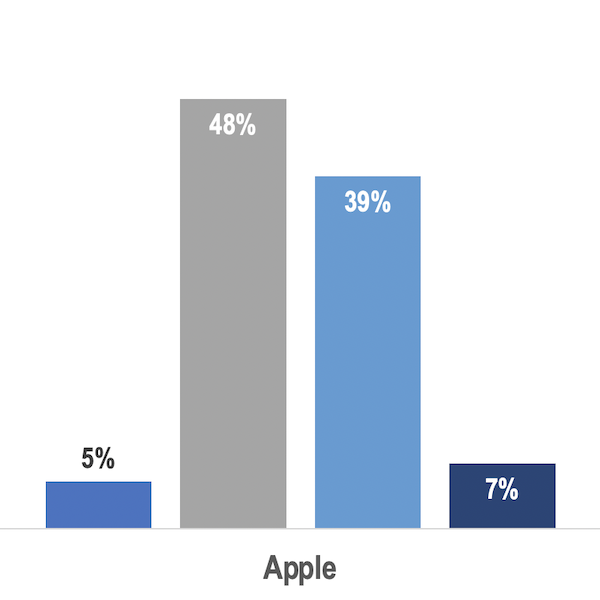

In 2018, Apple announced they would no longer publicly share the number of iPhone devices sold each quarter. Instead, they would focus on quarterly revenue as a way to include their growing services and subscription business. In the two years since this announcement, Apple has expanded its services business to seven offerings, including Apple Fitness+ and Apple One announced earlier this week. With this new revenue stream layered on top of the iPhone, Apple has been reducing the minimum starting price for the iPhone to expand their footprint and sell more services.

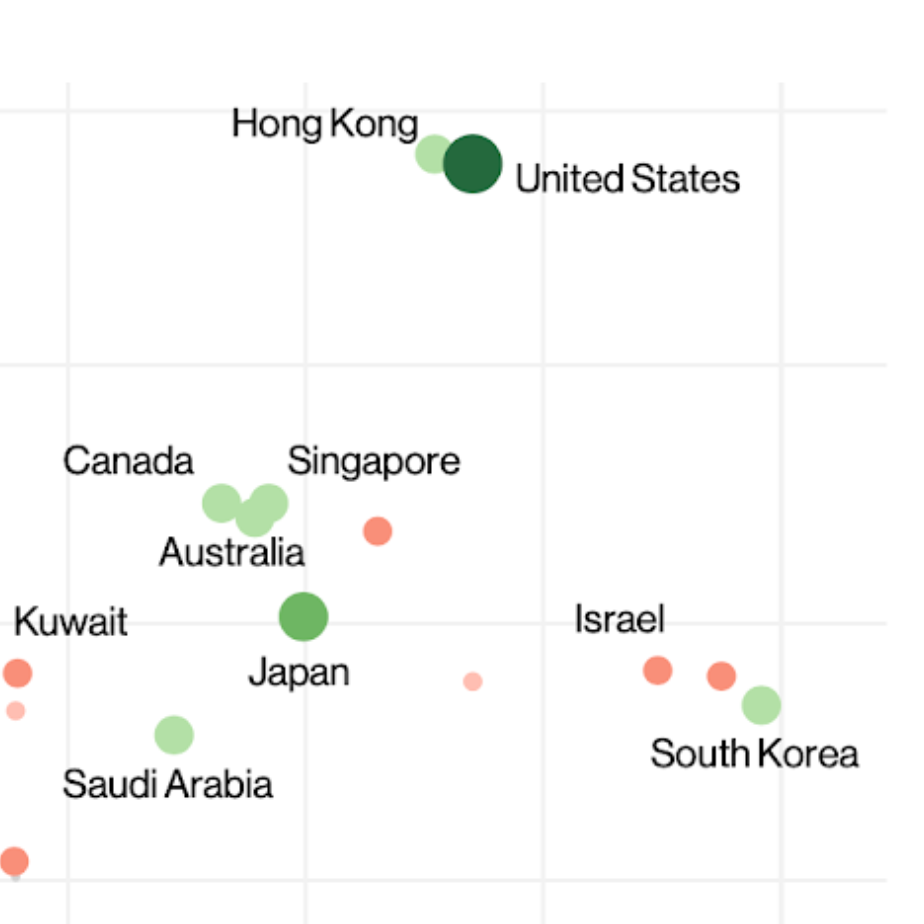

Samsung and Apple dominate the smartphone industry globally. Combined, they control more than half the total market share on the planet. In most regions of the world, either Apple or Samsung is the top vendor. While Apple leads in its home market of North America, Samsung tends to lead elsewhere. In this report, Flurry looks at the global market share by active user base. While most market share analyses estimate device shipments or sales, Flurry directly measures what phones are in use today.

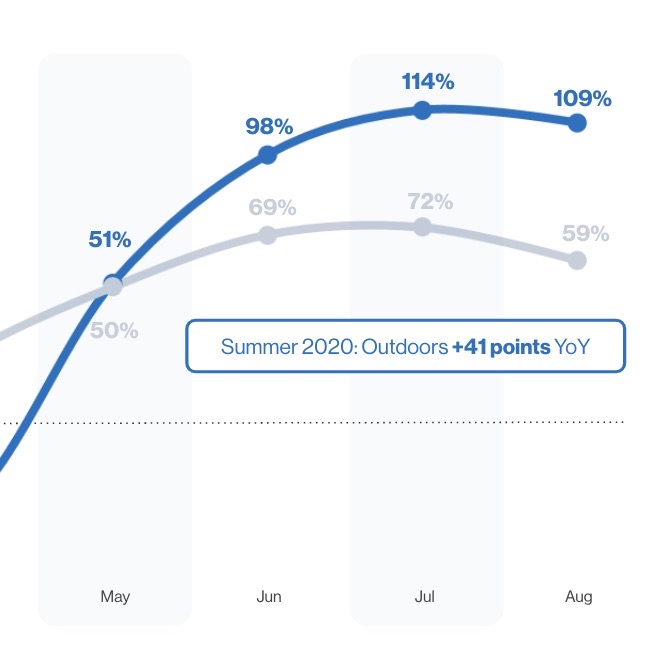

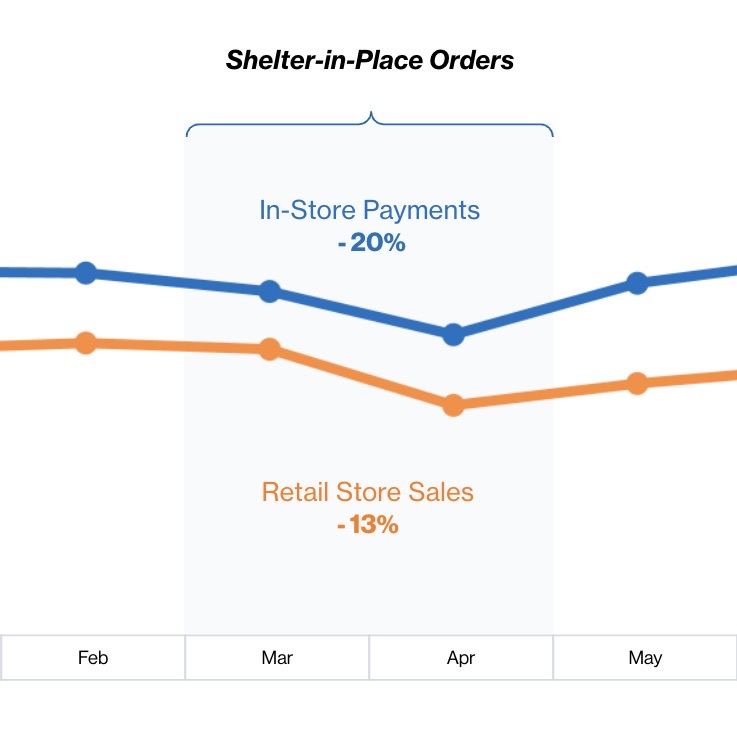

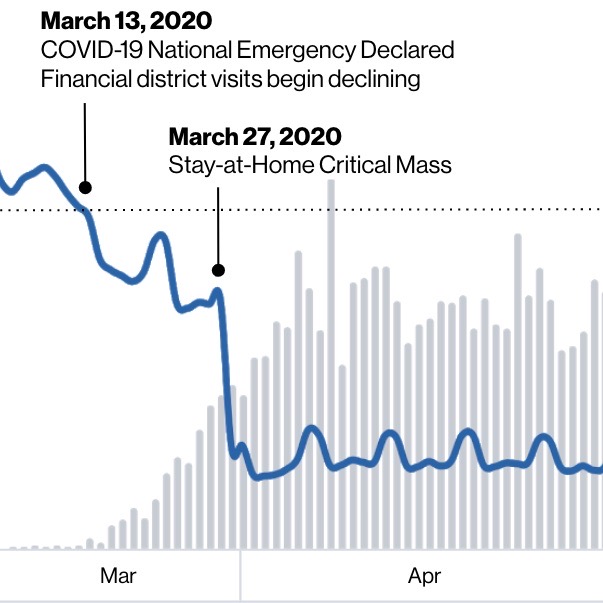

COVID-19 and the ensuing stay-at-home orders have caused mobile app usage to skyrocket. Consumers are looking to fill unexpected free time due to limited leisure activities and social distancing, meaning many of us are reaching for mobile devices to pass the time. Throughout the past few months, Flurry has investigated various shifts in user behavior due to the pandemic by looking at app usage across categories. For this report, we’ve compiled our recent findings into one document to demonstrate the cross-category impact of the COVID-19 pandemic. We hope you’ll take a look.

We are excited to announce a set of solutions to help publishers manage and understand the Conversion Value they set in order to measure post-install campaign performance. A new Flurry Analytics SDK will be available later this month to support this developer need ahead of Apple’s iOS 14 release.

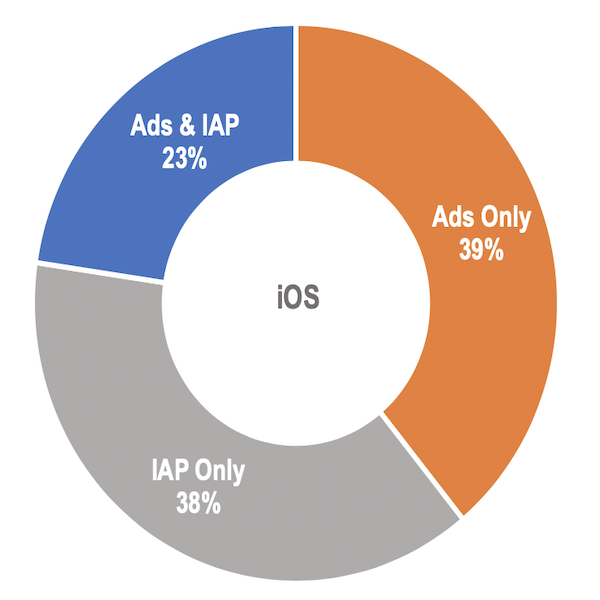

Since the App Store and Google Play launched over a decade ago, advertising has enabled app publishers to offer free, high quality applications. Even when users fail to explicitly pay an app publisher for the use of an app, the publisher can still earn revenue. With 76% of all apps generating revenue from advertising, according to a recent Ad Colony survey, the ad revenue model has been a cornerstone of app monetization—at least until this year.

Last week we explained why the release of iOS 14 will reduce publisher ad revenue and how Flurry can help reverse some of that impact. This week we focus on how iOS 14 will also impair mobile ad campaign attribution.

Gen Z and Millennials have grown up with mobile technology at their fingertips. Most don’t use landlines, or even cameras aside from the ones on their phones. Representing nearly half the population, and the bulk of consumer spending, major smartphone manufacturers are in a battle for their loyalty. In this report, we compare consumer demographics of Samsung smartphone and Apple iPhone users.

When Apple announced iOS 14, it outlined a new policy which requires app publishers to seek end user permission to access a user’s IDFA. While estimates on forecasted opt-in rates vary, the result is clear: the IDFA will become scarce. Among the implications for app developers, the most pressing is an expected large drop in advertising revenue. In this post, we’ll discuss how disabling the IDFA leads to a sizable drop in ad revenue.

As COVID-19 began to spread in the U.S., schools shifted to distance learning, non-essential businesses closed and many employees worked from home. This begs the question: without commutes, breakfast meetings, or morning spin classes, are Americans still waking up as early as they used to?

Pagination

- Previous page

- Page 4

- Next page