Samsung and Apple dominate the smartphone industry globally. Combined, they control more than half the total market share on the planet. In most regions of the world, either Apple or Samsung is the top vendor. While Apple leads in its home market of North America, Samsung tends to lead elsewhere. In this report, Flurry looks at the global market share by active user base. While most market share analyses estimate device shipments or sales, Flurry directly measures what phones are in use today. As a result, our analysis shows market share based on active devices, or true install base, which we believe is a more meaningful view of market share.

Flurry Analytics is used in over 1 million mobile applications worldwide, providing aggregated insights from more than 2 billion mobile devices per month. For this analysis, we exclude the European Union and China due to insufficient data. However, external analyses show that Apple and Samsung are the top two vendors in Europe and that Apple is second in China, only behind Huawei. Let’s take a look at the world map of active devices, broken out by continent.

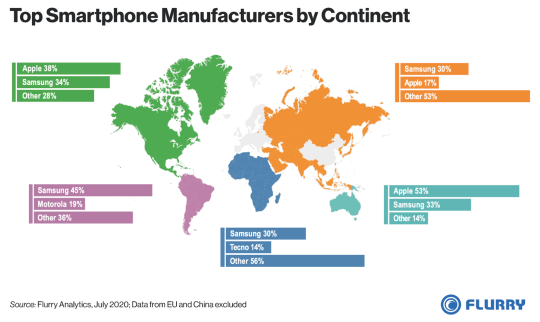

For each continent, we show the top two smartphone manufacturers based on their share of active devices. Scanning the mapping, you’ll notice that either Apple or Samsung leads on each continent, showing their strength as a duopoly. Aggregating market share based on the total map, Samsung has 33% of the market and Apple has 22%. Note again that this excludes data from China and the EU. Starting with North America, Apple makes up 38% of the active device base, followed by Samsung with 34%. In Asia (excluding China) and Australia, Apple and Samsung’s combined share totals 47% and 86%, respectively.

On continents where Samsung is the market leader, it tends to dominate. In Latin America, for example, Samsung leads Motorola by 36 percentage points. In Africa, Samsung leads Tecno by 16 percentage points. And in Asia, Samsung leads Apple by 13 percentage points. Apple, on the other hand, is the market leader in North America and Australia, two regions with higher income per capita, indicating that Apple appeals to users with more disposable income.

Outside of China, Tecno is the only Chinese manufacturer to earn one of the top two spots on any continent. In Africa, Tecno ranks second behind Samsung with a 14% share of active devices. Given Africa’s low smartphone penetration, Tecno could be well positioned to capture some of the continent’s forecasted growth in the years ahead. And it wouldn’t be the first time a Chinese manufacturer successfully took control of a foreign market because of their ability to manufacture quality smartphones at affordable price points. So we should not count Tecno, Huawei, Xiaomi or any other Chinese OEM out from successfully gaining share as the adoption rates rise in Africa and other emerging markets.

Apple could be well-positioned to gain share in several markets as they strongly appeal to a younger demographic, which means that their share will organically strengthen over time. For more insight into this trend, check out this Flurry report showing that those under 35 years of age strongly prefer iPhones. That said, Apple faces uphill battles in Latin America, Africa, and even parts of Asia. As of now, it appears that Samsung is well positioned to build on its existing lead. We’ll continue to monitor the active device share of top smartphone manufacturers. For the latest reports, subscribe to the Flurry blog and follow us on Twitter and LinkedIn to get the latest industry analyses.

iPhone is a trademark of Apple Inc., registered in the U.S. and other countries.

Flurry’s blog (flurry.com/blog) is an independent blog and has not been authorized, sponsored, or otherwise approved by Apple Inc. or Samsung.