While most of the tech media has congregated outside the Moscone Center in San Francisco waiting for the new Apple tablet, Kara Swisher of All Things D is across the street at the GMIC conference interviewing Lei Jun, the CEO of Xiaomi. Mr. Jun has plenty to talk about. Xiaomi’s newest flagship smartphone the Mi-3 sold 100,000 units in less than 86 seconds and the first batch of its flat panel TVs all sold in less than 2 minutes. Not even Apple can boast of such velocity driven by legions of devoted fans.

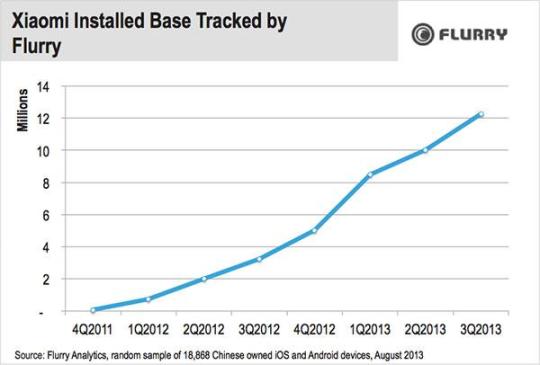

Since its first smartphone launch in August 2011, Xiaomi has been on a growth tear in its native China. Based on devices tracked by Flurry, Xiaomi’s installed base of phones has quadrupled since the third quarter last year. In a previous research report, Flurry reported that Xiaomi has become a serious challenger in the smartphone market capturing over 6% of the Chinese market, which is the largest smartphone market in the world. This is more than the market share of HTC and Lenovo and it happened in less than two years.

While consumers rave about Xiaomi’s slick design and performance, it is the company’s software and content strategy that is fueling its growth. Its early focus on mobile content has given it a clear differentiation from other device manufacturers. In addition, its focus on a closed ecosystem has allowed it to focus more on the consumer experience and allowed it to attract a legion of “fan boys” that snap up whatever device the company makes. Xiaomi’s largest critics believe that a closed ecosystem is hard to pull off. This is especially true in China where Tencent is well-entrenched in social networking and gaming and Alibaba has a strong position in e-commerce. However it seems that Xiaomi has found its “killer app” outside of social and commerce and is staking its claim.

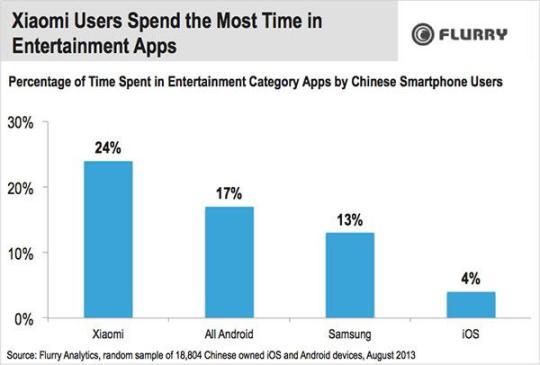

To get better insight into that killer app, Flurry looked at the app categories where Xiaomi users spend the most time. While gaming still dominates, it was interesting to see that Xiaomi users spent significantly more time in Media and Entertainment apps than Samsung or Apple users. Compared to iPhone users, Xiaomi customers spend five times as much time in Media and Entertainment aps. While the definition of what goes into Media and Entertainment apps is broad, think of it as content that consumed in the living room and in movie theaters (or the small and big screens.)

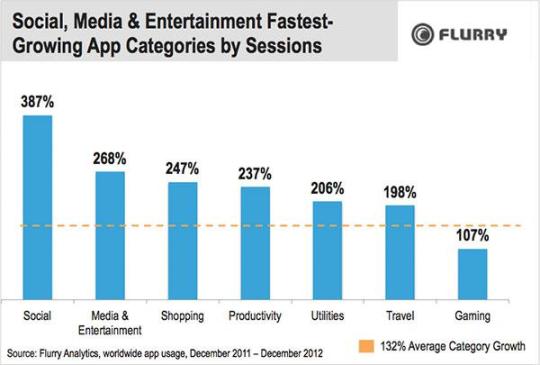

Could this simply be a sign of a shift in content consumed on mobile devices, or a clever focus on behalf of Xiaomi? Earlier in the year, Flurry released the below data, showing that Media and Entertainment was the second fastest growing category in mobile, growing much faster than gaming and slightly behind social networking.

So the growth of Media and Entertainment apps is a worldwide phenomenon, but it appears that Xiaomi has claimed its stake in that market segment very strategically and successfully. Taking a page from history, Blackberry used email as its entry point into the smartphone market, unseating Nokia. Then Apple came along and used Music and iTunes (and its access to people’s credit cards) as its entry point into market, unseating Blackberry.

With Media and Entertainment as its entry point and successful entry into the flat panel TV market place (besting Apple), it appears that Xiaomi has taken a page out of Netflix’s playbook to beat the competition at the content game. Granted, today it is “just” China, but Xiaomi is not stopping at its home market. Its latest hire indicates that the company’s ambitions are way beyond the Chinese borders. While its CEO is known to dress like Steve Jobs, it is Netflix’s Reed Hastings, whose long-term focus is on cutting the cable cord and “owning” a good portion of the Media and Entertainment industry, that Mr. Jun needs to be compared to.