Retail is among the world’s largest industries. The top 10 global retailers are made up of 5 from the U.S. and 5 from Europe, collectively driving annual revenue in excess of $1.1 trillion. The U.S. Commerce Department estimates that U.S. domestic revenue exceeded $4.7 trillion in 2011 and is growing. Two thirds of the U.S. GDP, the world’s leading economy, comes from retail consumption.

Now, the retail industry is colliding with the mobile app economy. Just consider that, according to a recent IBM report, more than 18% of shoppers used a smartphone or tablet to access a retailer’s website on Cyber Monday in 2012, an increase of 70% over 2011. Mobile made up 13% of total web-based purchases. The App & Mortar economy has arrived.

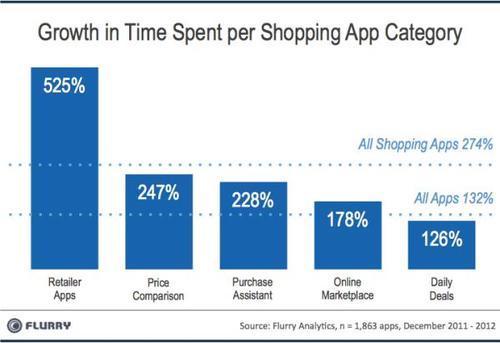

In this report, Flurry explores the shopping app category. For our analysis, we measured time spent by consumers across more than 1,800 iOS and Android shopping apps from December 2011 to December 2012. Shopping apps were found predominately within the Shopping category on Google Play, and within the Lifestyle and Food & Drink categories in the Apple App Store. From there, we broke down “Shopping” into five sub-categories: Retailer Apps, Price Comparison, Purchase Assistant, Online Marketplace and Daily Deals. Let’s take a look at how time spent in shopping apps is growing.

The chart above shows growth in time spent by consumers across the top five shopping sub-categories. For reference, indicated by the dotted light-blue lines, we overlay growth rates for All Shopping Apps and for All Apps that Flurry measures (over 270,000). Starting on the left, we see that consumer time spent in Retailer Apps has skyrocketed by 525% from December 2011 to December 2012. This growth far exceeds total shopping app growth of 274%, as well as overall app growth 132%, represented again by the light-blue dotted lines. Time spent in Price Comparison and Purchase Assistant apps have also grown significantly, by 247% and 228%, respectively. Finally, still growing, but not as quickly as other shopping categories are Online Marketplace and Daily Deals apps at 178% and 126%, respectively.

For reference, below are examples of the kind of apps across shopping sub-categories in this analysis. Please note that example apps may not be Flurry customers.

In the chart above, we next look at the shift in time spent across shopping sub-categories. Retailers, represented by the dark blue wedge, saw the greatest increase in time spent, from a share of 15% of time spent by consumers in shopping apps in 2011 to 27% in 2012. The enormous growth in retailer app share has come largely at the expense of Daily Deals, down in share from 20% in 2011 to 13% in 2012, and Online Marketplace apps, which contracted from 25% in 2011 to 20% in 2012. This suggests that retailers are beginning to better respond to the tectonic shift created by the collision of online- meeting offline-shopping through mobile apps.

The opportunity for retailers to extend their relationship with consumers outside the store has never been greater, or more mission critical. Gone are the days when retailers should focus the majority of their marketing effort attracting consumers into stores, where 95% of all purchases take place. In the new mobile app economy, devices are always with you, always on and always connected. Consumers can be intercepted in store aisles and even on their way to the cash register. There are apps to scan an item, select size and color, and then have it shipped to your home - conveniently, quickly from the phone you have in your pocket right now. Apps are connected to credit cards and can have shipping info on file. In the new App & Mortar economy, they serve as virtual, portable show rooms that consumers can use to shop anytime, anywhere.

To keep dollars flowing through their cash registers, retailers need to re-examine the consumer relationship from the ground up and through the lens of mobile-first. In the App & Mortar economy, the battle for deeper consumer relationships is beginning. And there are already thousands of apps for that.