Over the past four years, Apple’s iOS and Google’s Android have been locked into a two horse race for mobile OS ownership. In the past year, there has been a lot of focus on the rise of Android and its lead in device market share. More recently, many analysts started questioning the true value of Android’s market share especially in the high-end smart phone and tablet markets. At Flurry, we felt that it was important to take a step back and look beyond straight device or activation numbers to simply understand what market or markets are being contested.

In this report we do just that, arguing that there is more than one race for mobile market share occurring simultaneously. We analyzed four years worth of Flurry’s data to understand who is ahead in which contests, discuss the apparent strengths and weaknesses of the competitors, and consider the implications for the overall mobile ecosystem.

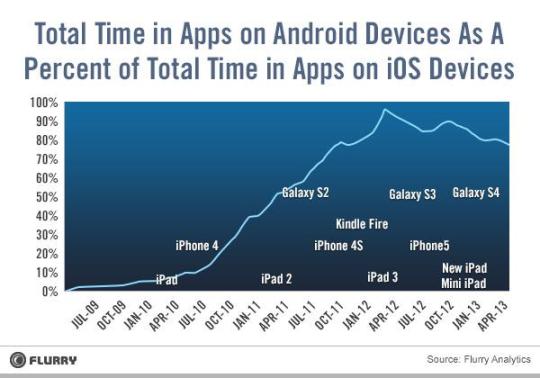

In spite of Android’s rapid rise and current lead in device market share, iOS continues to lead in terms of time spent in apps. Total time in Android apps nearly equaled that in iOS apps in March of 2012, but it has declined somewhat since then, after the launch of the 3rd generation iPad.

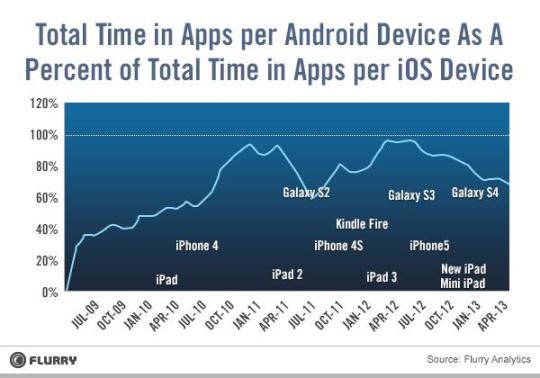

Considering that there are more active Android devices than iOS devices but iOS users collectively spend more time in apps, it’s not surprising that more time per device is spent in iOS apps than in Android apps. The exact proportion of time spent in apps per Android device relative to iOS devices is shown below.

An obvious question that arises when looking at the charts above is why app usage shares don’t follow device shares. We think there are at least three possible explanations.

One is that at least up until now the two dominant operating systems have tended to attract different types of users. Once Apple established the app ecosystem many of the consumers who purchased iOS devices were doing so to be able to run apps on those devices. They were buying a computer that fit in their pocket or purse. In contrast, many Android devices were provided free by carriers to contract customers upgrading feature phones. To the extent that those customers were just buying replacement phones, apps may be a nice add-on, but not a central feature of the device.

A second possible reason for why Android’s share of the app market lags its share in the device market is that the fragmented nature of the Android ecosystem creates greater obstacles to app development and therefore limits availability of app content. Hundreds of different device models produced by many manufacturers run the Android operating system. App developers not only need to ensure that their apps display and function well on all of those devices, but they also need to contend with the fact that most devices are running an old version of Android because the processes for pushing Android updates out to the installed base of Android devices are not nearly as efficient as those for pushing iOS updates to iOS device owners.

The final possible explanation for the differences in device and app usage shares relates to the first two. It is that the arguably larger and richer ecosystem of apps that exists for iOS feeds on itself. iOS device owners use apps so developers create apps for iOS users and that in turn generates positive experiences, word-of-mouth, and further increases in app use.

While app share and device share are two key races in the competition for mobile supremacy, they are not the only races. Another that has been in the news recently is the race for profits, in which Apple is the clear leader. Apple also currently appears to be winning the race for developer attention – probably both because of its share of app usage as described above and because both surveys and anecdotal evidence indicate that iOS device owners tend to generate greater advertising and in app purchase revenue.

A side race that Android appears to be winning is that for the emerging world, where its lower prices and open architecture give it an advantage. Apple has taken notice of that and is fighting back with incentives, monthly payment plans and cash backs in several emerging countries. In India, for example, a Times of India article suggests that these programs have given the iPhone a 400% boost in sales in the past few months.

As we’ve shown, there are multiple contests for mobile market share occurring simultaneously. That raises a question about whether that is a temporary state that will eventually give way to a clear overall winner or if there can be multiple long-term winners. For the moment it seems as though the consumer is winning in that they are able to choose devices from two dominant ecosystems as well as several smaller ecosystems.