The Super Bowl is an American phenomenon, now largely considered a de facto American holiday. As a premier media event, it regularly attracts record-breaking audiences. This year, Super Bowl XLVI became the most watched television program in history, drawing an audience of 111 million viewers according to The Nielsen Company. Prior to this, the record was held by last year’s Super Bowl, which itself had overtaken the number one spot held for twenty-eight years by the final episode of M*A*S*H.

Also breaking new ground this year was the concept of the “second screen,” which illustrates that while watching TV (the first screen), people often interact with second screens such as smartphones and tablets. To keep viewers focused on the first screen, marketers increasingly are exploring ways to complement the first screen experience with the addition of hash tags, QR codes, voting and more. Among the most ambitious is Shazam, a music and media discovery service, which worked with ad partners such as Toyota, Best Buy, Pepsi, Bud Light and Fed Ex to drive additional second screen interactions related to advertising via the Shazam mobile app. During the halftime show, for example, viewers could get the setlist, buy music and download mobile apps from the artists. Shazam reported millions of audio tags as a result.

Aside from a handful of innovators like Shazam, Flurry believes that the second screen is still largely more disruptive than complementary to first screen viewing. If a consumer is not paying attention to the television program in front of her, she is likely using an application to post social updates or play games. For example, if a Super Bowl ad isn’t holding a viewer’s interest, playing another round of Words with Friends is a likely activity. Monitoring app usage provides Flurry the ability to understand this tightly-coupled relationship between the first and second screen.

For this report, Flurry tracked U.S. app usage, per second, over the course of Super Bowl XLVI, mapping application session starts to each television spot aired, game time segment, the halftime show, and more. We further studied behavioral differences between males versus females. With Flurry Analytics in over 160,000 applications, the company detects app usage on more than 90% of all iOS and Android devices per day. Let’s start by comparing how many people used apps during the Super Bowl to the number who watched the Super Bowl.

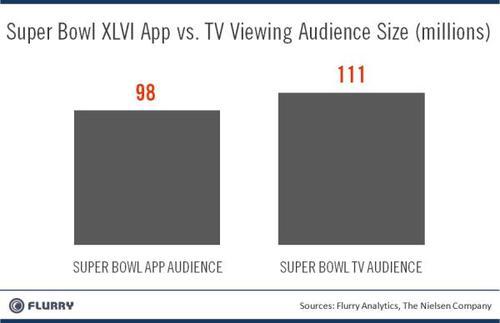

The left-hand column shows the number of users Flurry estimates launched applications in the United States between the hours of 3:15 and 7:15 PM PST on Sunday, February 5. During this four-hour window, in which the Super Bowl was played, Flurry estimates that nearly one-third of the U.S. population used an application. Compared to Nielsen’s estimate that 111 million people watched the Super Bowl this year, the two audiences are similar in size.

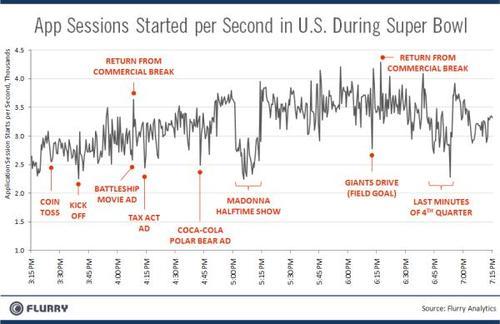

The chart above shows estimated app session starts in the U.S. per second. Studying overall trends reveals a highly correlated, inverse relationship between app usage and game, halftime and commercial events. Generally, app usage increased steadily over the first three quarters of the game, showing the challenge in holding peoples’ attention over several hours. However, because this year’s game was close throughout, including an exciting fourth quarter finish, app usage remained relatively checked. Noticeably, app usage declined significantly during the last part of the fourth quarter. The most clearly visible change in app usage occurred during Madonna’s half time show, where app usage remained consistently low for the longest, sustained period of time. From this, we conclude that Madonna strongly held viewers’ attention on the first screen and was a major draw for the Super Bowl this year.

Looking more closely at the details, we see that key moments like the coin toss and kick off were paired with decreases in app usage. Additionally, we found that advertisement popularity could be inferred from rises or declines in app usage. For example, if app usage increases during an ad, we conclude that it did not hold the consumer’s attention. While there is the possibility that certain advertisements encouraged the use of an app, this was not the norm. Studying male versus female usage differences, we found that 62% of overall app usage during the game was driven by females. Flurry also found that women, on average, paid more attention to advertisements, and drove spikes in app usage upon return to the game after commercial breaks.

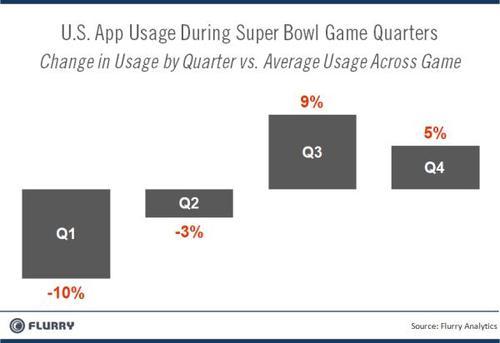

In this chart, we isolate app usage during broadcast game time only. All breaks for advertising have been excluded. This chart displays a clear pattern of usage by quarter. To create the chart, we took an average for app usage across the entire game, and then for each quarter. Starting on the left-hand side, app usage was lowest during the first quarter. The second and third quarters show increases in app usage, as we assume peoples’ attentions waned over the long course of the game. The fourth quarter, however, shows a decline in usage due to the game’s close finish, which drew attention back to the first screen.

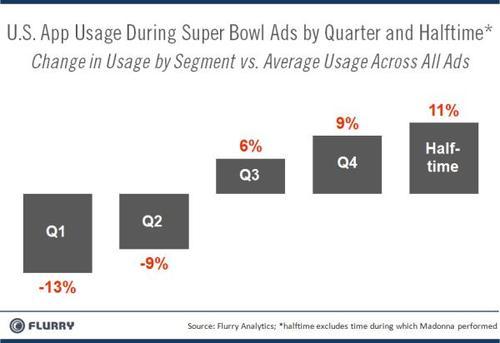

In this chart, we isolate app usage to only those times when advertisements were aired. Again, consumer fatigue played a role in attention paid to the first versus second screen. Even with a close Super Bowl game, viewers paid far less attention to ads during the second half. This would suggest that when buying ad times, advertisers should focus on Q1 and Q2 ad slots. Not shown on the chart, pre-game ads, as early as 20 minutes before game time, also held consumer attention well. Half-time, outside of Madonna’s half time show fared worst for holding consumer attention. We speculate that people were either taking a bathroom break or looking for information and/or content on their phones related to Madonna or other artists that appeared in the show.

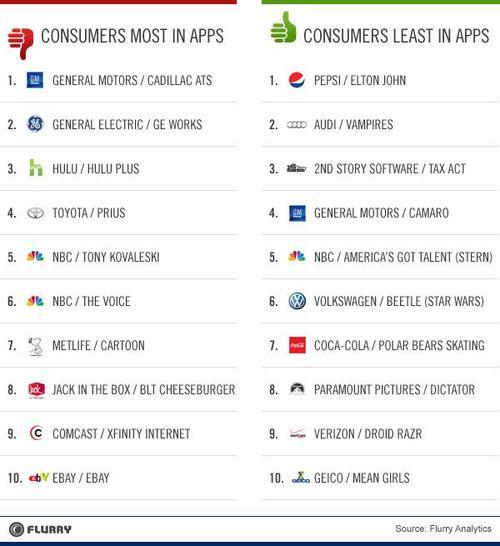

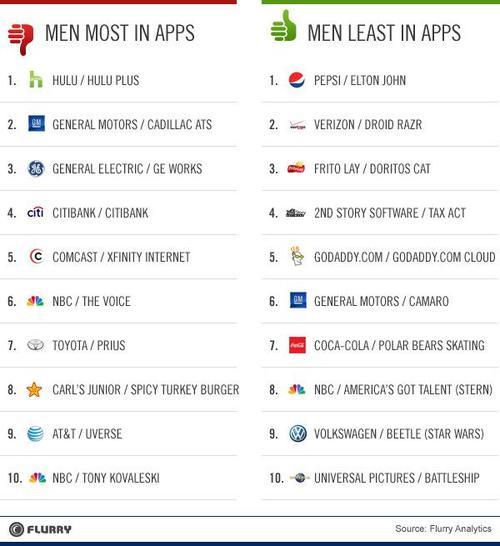

Finally, Flurry ranks ad Super Bowl ad performance. During the times app usage spikes, we assume ad fail to appeal to the viewer. Conversely, if app usage declines during a TV spot, we assume that the first screen is where the consumer is focused. For each ad, Flurry counted the number of app sessions starts. We then divided that number by the number of seconds in the ad, to get an average number of session starts per second. This gives an apples-to-apples comparison for comparing varying ad lengths. Below, we share rankings for Overall, Male and Female user groups. By our count there were over 100 ads from pre-game through post-game.

The relationship between advertisers and consumers continues to change, with apps playing a key role. In a year when the industry is anticipating major moves from companies like Apple and Google around interactive television, app makers and marketers will need to learn and adapt. In the meantime, we know that Madonna still has the power to make you put your phone down, at least for a while.