Many of us at Flurry love Mad Men, but we believe that Don Draper’s advertising industry is ancient history. Don would probably mistake smartphones for cigarette cases and tablets for coasters. More importantly, sophisticated buyers and sellers in today’s advertising market are making decisions in real time based on masses of data rather than months in advance based on charm and corporate hospitality. Advertising buying is being disrupted by efficiency gains from real time bidding (RTB) and effectiveness improvements achieved by using big data to inform mobile advertising transactions.

Recently Flurry launched an RTB Marketplace that enables advertisers to bid for the attention of smartphone and tablet users one at a time. We are betting big on the trend toward programmatic buying for two reasons. First, it enables precision targeting that was unimaginable in the pre-digital age and is still uncommon. Buying ad exposures one at a time enables advertisers to reach precisely-defined audiences wherever they are and whenever they use their devices. That level of precision would always have been useful, but it is especially important now that consumer interests, preferences, and lifestyles have become so varied.

Second, RTB brings a new level of efficiency to ad buying. The whole nature of an auction means that an advertiser who is willing to pay the most to reach a certain type of person will earn the opportunity to do so. The price advertisers are willing to pay provides a clear signal of the relative value they place on a customer or potential customer.

In this post we share initial results from our Marketplace to illustrate the power of combining the price signals provided through RTB auctions with the individualized targeting capabilities made possible by big data.

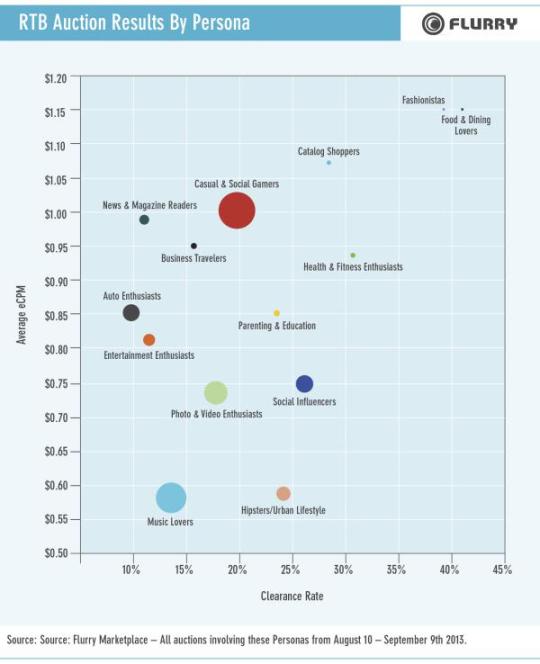

The chart below illustrates three important results related to the value advertisers place on different types of mobile users and the available supply of those people’s in-app attention. The items being plotted are Flurry Personas. These are groups of devices whose owners access particular types of apps more frequently than people using other devices do.

The size of the bubble associated with each Persona represents supply, or the relative number of auctions for the right to serve an impression to a device in the Persona. Of the Personas shown here the greatest number of available impressions were for Casual and Social Gamers and the least were for Fashionistas and Food and Dining enthusiasts.

The x-axis, clearance rate, shows the percentage of auctions that had a winning bid, resulting in an advertiser displaying an ad on a device. As can be seen by looking at the right bound of the x-axis, less than half of the auctions had a winning bidder. This is a normal and expected result in RTB auctions. Reasons for auctions not clearing include price floors being set too high, bidding technologies used by advertisers’ representatives responding too slowly, some publishers being able to sell their ad inventory for higher prices elsewhere, and advertisers being uninterested in the inventory some publishers offer.

The y-axis shows the average effective cost per thousand impressions (eCPM). Even though these impressions are sold on an individual basis that is still the common pricing metric.

Examining supply, price, and clearance rate together reveals a lot about the state of play in the mobile advertising market. First, the fact that Fashionistas and Food and Dining Lovers are in the upper right corner implies that those Personas are of greatest interest to advertisers. It seems logical that those would be desirable psychographics, but the limited supply of ad inventory for those Personas also helps explain why prices and clearance rates are high. It means there are opportunities to generate mobile advertising revenue by publishing apps and content that attract Fashionistas and Food and Dining Lovers.

At the other extreme, Music Lovers and Hipsters have relatively low clearance rates and relatively low average eCPMs. While the supply of impressions for these groups within our Marketplace is not particularly large (as shown by the medium-sized bubbles), we hypothesize that people in these Personas are fairly easy to reach outside of our Marketplace because music fans spend a lot of time in music apps and many apps attract mobile-savvy Hipsters. It also makes sense that advertisers compete less aggressively for Music Lovers considering how inexpensive music is now compared to the pre-Napster era.

The overall diagonal pattern formed by the personas shows that the market is working efficiently, as expected. How do we know that? If a Persona had a high clearance rate but a low average eCPM we would expect advertisers to bid up the price to secure inventory. The fact that there are no Personas in the lower right corner shows that is exactly what has happened.

A position in the upper left corner of the chart means that auctions to advertise to that Persona have a high average eCPM given their rate of clearance. Here, we would expect publishers to drop their floor prices to achieve higher clearance rates. The fact that there are no Personas in the extreme upper left corner suggests that is also happening. There are some Personas with positions approaching that upper left corner: News and Magazine Readers are the most extreme example. We see two possible explanations for why those publishers didn’t drop their floors in search of higher clearance rates. One is that some of those publishers are able to sell impressions that don’t sell through our Marketplace direct or to use them themselves (i.e., to promote their own properties). The other is a policy of keeping prices above a certain level to maintain a premium image even if it means sacrificing short-term revenue opportunities.

RTB moves at lightning speed. A publisher can shop a single impression in the nanosecond before the winning ad appears. Compare that to the speculative, mass-market approach of the Upfronts, and it’s easy to see that advertising buying is likely to be completely disrupted by RTB.

The Persona-based targeting described in this post demonstrates the power of data to inform each bid. Advertisers no longer need to make buying decisions based on stereotypes about which types of people are interested in what type of products or content. They can define their target audience precisely, and aggregate that exact audience efficiently impression by impression. Mobile also contributes to this type of precision targeting since smartphones are highly personal devices loaded with apps that reveal much more about the person looking at the screen than standard demographics ever did. The long held promise of digital advertising is finally being realized on mobile.

All of this leads us to believe that advertisers or publishers who want to do things in the old way may be better off kicking back, pouring themselves a drink, and watching an episode of Mad Men instead of entering the fray in the mobile advertising space where data-fueled RTB is sure to win.