Mass market consumer adoption of Apple iOS and Google Android mobile devices has attracted an unprecedented volume of content, delivered through applications. Because the majority of these applications downloaded are also free, many ecosystem players have assumed that advertising revenue models will dominate how these apps are monetized.

However, new analysis by Flurry reveals that the sale of virtual goods is overtaking advertising in top categories on the iOS platform. Note that because Google’s Android Market does not yet support in-app purchases (micro-transactions), this model is not yet viable for Android apps. This study was conducted using data collected from a sample of leading iOS social networking and social gaming applications, with a combined reach of 2.2 million daily active users.

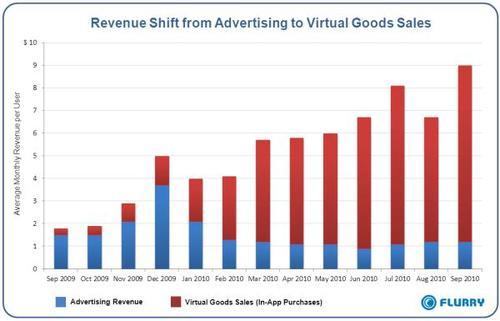

Reviewing the chart above, the majority of revenue generated from advertising occurs during the 2009 holiday period. During 2010, however, revenue increasingly shifts from advertising to virtual goods sales until reaching a proportion of more than 80% from virtual goods. Admittedly, the idea that consumers acquiring virtual swords, gold coins and respect points can outperform advertising seems counter-intuitive; however, this phenomenon is neither new nor unique to the iOS platform.

In fact, virtual goods sales already represent the primary source of revenue for social gaming on Facebook. Michael Pachter, Wedbush Morgan Securities video game analyst, reports that social gaming has grown from approximately $600 million in 2008 to $1 billion in 2009. Further, he forecasts that social gaming will generate nearly $1.6 billion this year, and grow to more than $4 billion by 2013.

One factor responsible for low advertising levels may be advertising agencies’ slow acceptance of mobile as a media platform, with skepticism about the viability of social games and social mobile media as a channel for advertisement. With these agencies representing and guiding the biggest brands, they appear to be missing a meaningful opportunity to reach a mass market of consumers who have adopted new platforms and forms of content.

As social games continue to expand their consumer reach, demonstrating their ability to attract an audience beyond teenagers using iPod touches, their relevance will increase. In fact, with mobile social game critical mass now rivaling TV prime time viewership, Flurry anticipates a stronger ad revenue generation through mobile social networking and games in 2011. Over the next 18 to 24 months, Flurry predicts strong revenue growth from both virtual goods and advertising revenue from social gaming. We say play on!