GDC is in San Francisco this week, just next to Flurry’s headquarters. By the size of the crowds, we (very scientifically) estimate that attendance should easily surpass last year’s record of 22,500. Having tracked the growth of mobile games for several years, we weren’t surprised to see more than 30 sessions during the week focused on smartphone and tablet gaming.

Here’s the big picture, based on our estimates: There are now over 1 billion active smartphones and tablets using apps around the world every month. And of all the apps consumers use, games command more than 40% of all time spent. Looking at revenue, games also dominate. Today, for example, 22 of the top 25 grossing apps in the U.S. iTunes App Store apps are games. Gamers spend money, and game makers are in love.

In this installment of research, Flurry studies how age, gender and engagement vary across key game types. Understand this, and a game developer can design a more engaging game that appeals to the right audience. In short, they can build a better business. In this study, we included more than 200 of the most successful free iOS games, with a total audience of more than 465 million month active users. For a better comparison, we organized these games by their game type (aka game mechanic) instead of traditional, less granular genres. Let’s start by looking at how different kinds of games appeal to gamers by age and gender.

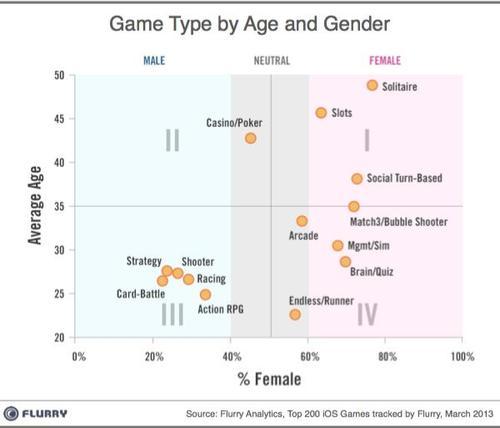

The chart above plots game types by age and gender. From left to right, we show what percent of the game audience is female, with the far right equaling 100% female. The opposite is true for males. For example, 0% female equals 100% male. From bottom to top, we show the average age of the game type’s user base, between 20 to 50 years old. Putting it together, games in the upper right quadrant are preferred by older females. Games in the lower right are preferred by younger females. Games in the lower left are preferred by younger men, and so on.

Inspecting the chart, the tightest cluster appears in the lower left; specifically, game types such as Shooters, Racing, and Action RPG skew younger and more male. Card-battle and Strategy games also skew toward younger males. The only genre that skews toward males over 35 is Casino/Poker, with pure poker games skewing even more male than the game type as a whole. This appears to leave a big gap in the market for developers who can create games that appeal to middle-aged and older men.

While men tend to gravitate toward competitive games, women gravitate toward games that are less competitive and tend to be played in a more enduring way. These include Management/Simulation games where players can build out an environment, Social Turn-Based games in which they can play over time with friends, and Match3/Bubble Shooters and Brain/Quiz games, to which users can frequently return when they have a few spare minutes. Slots and Solitaire are both solo-play game types that skew toward females who are over 40, suggesting that they serve as long-term time-fillers.

From a marketing perspective, mobile game publishers can also leverage this knowledge to design targeted campaigns appropriate for the kind of audience to which a game appeals. Flurry’s ad network, AppCircle, allows publishers to target specific demographics for efficient spending.

We find that mobile gamers tend to prefer playing a few kinds of games and demonstrate highly predictable play patterns. In other words, they form relationships with their games. Savvy publishers understand these dynamics and use them to inform acquisition strategy, gameplay design, and both in-app purchase and ad-based monetization tactics.

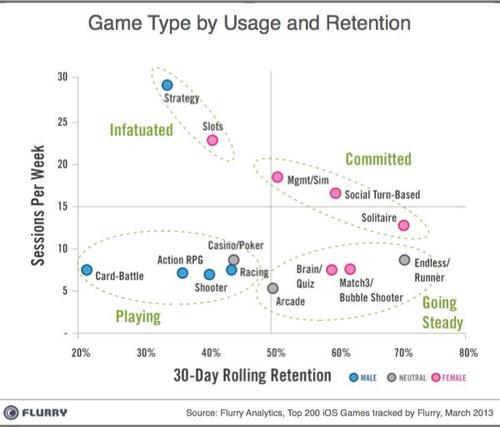

In the chart below, we map game types by usage and retention. On the y-axis we show the number of times per week consumers play different game types. On the x-axis we show how long different games retain their user (i.e., Flurry defines Rolling Retention as the percentage of users that return to the game 30 days after first use, or any day after that). To see how usage and gender work together, we’ve also colored-coded game types by whether they are more male, female or neutral in appeal. Let’s take a look.

The chart above reveals that different strategies should be employed for different kinds of games. It also shows, loosely, that women are more committed while men are more fickle. Sound familiar in life? Hmmm. For the gaming industry, the universal take away is that to optimize engagement, retention, and monetization, developers must tailor their mechanics and messaging to match their ideal target audience. Let’s take a tour of the quadrants.

“Players” try a lot of different games, play for only a short time and tend to be found in highly competitive games (e.g., “Player vs. Player style games). While fickle, they tend to have a high willingness-to-pay in order to progress faster in a game or increase their ability to compete at a high level versus other players. Attracting the right users through targeted acquisition can pay off, as those that stay will pay. Notably, Card-Battle games have very low retention but off-the-charts monetization, extracting enormous revenue from the small number of users that stick. One implication is that these games need to be highly polished at launch with updates ready to go, as gamers will discard games quickly and move on if the game fails to resonate. From a design standpoint, these games should offer immediate opportunities for users to advance by purchasing upgrades and boosts. For the users that might not spend, a lucrative option is to offer in-game currency for watching video ads.

“Going Steady” game types are found in the lower right quadrant of the chart. Usage is less frequent but retention is very high. While these gamers don’t play as often, they are loyal. This group of games tends to be easy-to-learn and easy-to-return-to even after a lapse in playing. They lend themselves to quick play while in a “wait state” (e.g., waiting in line, taking a bus or perhaps checking out of the meeting or class they’re in). Since these are not particularly immersive or competitive games, they are less likely suited to in-app purchase. However, they can generate significant ad impressions over time, and can be designed to show banner or interstitial ads without being overly disruptive to the experience. For games with larger audiences, publishers are utilizing mediation platforms that enable the use of multiple ad networks in one system, ensuring maximized fill and ad-revenue for each space.

“Committed” comprise of consumers who play games for the long-haul. As such, game makers should think of it like a marriage. Think about appoint mechanics like setting a date (hey, even married people need to keep it fresh). These games should be designed with deep content and not try to sell too hard to their users too quickly. From a monetization perspective, commitment-oriented games have great potential for in-app purchases since users of those games are likely to value such purchases and amortize them over long periods of gameplay. And while only the largest titles have achieved this to-date, this group of games are great candidates for in-app product placement. Additionally, with high impressions counts, it is worth publishers’ investment to implement monetization platforms that make ad spaces available to real-time bidded ad exchanges, ensuring they reach the brands and advertisers that value their audiences.

“Infatuated” consumers have fallen hard and fast for their games, but the candle that burns twice as bright burns half as long. They have crushes, and show binge behavior. During the “crush” window, the developer needs to work hard to extract as much revenue as possible. As such, developers must provide vast amounts of content to the users, consistently, in a short-window. Matching monetization to game type, the competitive nature of Strategy games, and Slots users’ incessant desire for in-game currency, make a solid in-app purchase strategy paramount. Sales, events, and purchase opportunities timed with key moments of emotional investment can drive significant profits for publishers.

In gaming, there are a vast number of game types that attract distinct audiences. And these different consumer segments display very different usage patterns, which have direct implications on monetization strategies. As in life, where the richest relationships are borne from knowing oneself and his or her partner, game companies must also understand both. Only then can you get the most out of the relationship.