With its stronghold in the United States, Apple iPhone sales during Christmas are nothing short of critical for the company’s continued success. In this report, Flurry evaluates the iPhone 11 launch, from September up through the first week of December.

Flurry additionally reviewed device activations of the iPhone 11, iPhone 11 Pro, and iPhone 11 Pro Max, comparing those to activation trends of earlier models such as the iPhone 7, 8 and X series. Flurry Analytics, part of Verizon Media, is used by over 1 million mobile apps, providing aggregated insights across more than 2 billion active mobile devices per month. Let’s dive in, starting with some important context.

The Release Machine

Each Fall, starting in 2007, Apple has released a new set of iPhones. Some pushed the boundaries of innovation while others delivered more incremental improvements. Up through the release of the iPhone 7, introduced during September 2016, unit growth was exceptional. However, with the launch of the iPhone 8, Apple began facing a combination of market saturation, increased competition and slowing device replacement cycles. In many ways, newer iPhones competed against the quality of Apples’ own older iPhones, as customers held onto their devices past the typical two year period. As the category matured, Apple unit growth slowed. Apple was entering a ‘post-iPhone era.’

Let’s Talk Revenue

In November 2018, Apple announced that it would no longer report unit sales, and instead report revenue. Leveraging its massive iPhone install base, the company began extending revenue through wearables (e.g., Apple Watch, Beats, AirPods) as well as services (e.g., AppleCare, App Store, Apple Pay, Apple Music and the latest Apple Card credit card). While the company continues to set record revenues – its market cap surpassed $1 trillion in October as it toppled Microsoft to become the world’s most valuable company – much of its continued success relies on a healthy iPhone install base onto which services and wearables revenue is stacked.

A Perfect X?

While this year’s iPhone 11 release (2019) is viewed as more incremental, last year’s XS, XS Max and XR (2018) offered a bigger jump in technology, extending strongly on the previous year’s initial release of the iPhone X (2017) which was co-released with the iPhone 8 and 8 Plus. In particular, the iPhone XS devices pushed the boundary of price points with the fully loaded, high-end XS Max topping out at around $1450. As unit sales slowed, Apple sought to push price points up.

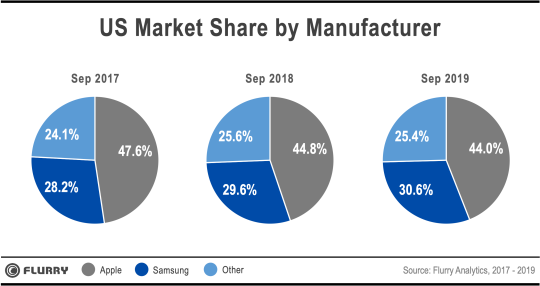

Most importantly, the success of the iPhone XS, XS Max and XR have helped stabilize the company’s dominant, but declining market share in its most valuable market, the United States. Let’s take a look at the multi-year market share trend.

The chart above compares market share in the United States between Apple, Samsung and Other device manufacturers. We selected the full month of September across each year for consistency, and because that’s when Apple typically releases its new devices. Sales of new Apple devices tend to accelerate across October, November and December on their way to Christmas Day, when the largest surge of devices enters the market. From 2017 to 2018, Apple’s share of active devices dropped by nearly 3 percentage points, whereas it stemmed its decline in market share between 2018 and 2019 to just under one percentage point, strongly stabilizing its market share position. From 2017 to 2018, Samsung gained around 1.5 percentage points in market share, but saw slower growth of 1 percentage point between 2018 and 2019. Combined, the Apple and Samsung duopoly managed to reverse market share erosion caused by the rest of the pack. Notable players in ‘Other’ category include LG and Motorola which held 8% and 4% of the US market, respectively, as of September 2019.

Based on prior Flurry analysis, we know that the 2017 iPhone 8 launches were relatively weak compared to the 2018 launches of the premium XS and XS Max models, which extended on the new X platform released by Apple at the end of 2017. In 2018, Apple also changed tack by releasing a high-value yet lower-priced iPhone XR, about a month after releasing the more premium XS devices. The XR not only performed exceptionally well last Christmas, but also continued to drive significant adoption throughout 2019. In short, we believe that the XR has been the primary ballast for Apple’s market share during 2019. And it looks as though the trend is continuing, even after the iPhone 11 launch.

The iPhone XR Juggernaut

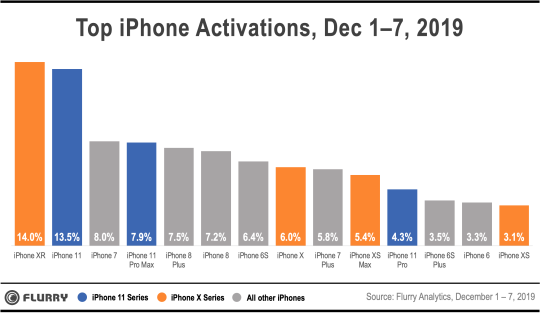

Below is a percent breakdown of the top iPhone models activated in the market during the first week of December 2019. We color-coded the iPhone X series devices orange, the iPhone 11 series blue, and all other devices grey. Inspecting the chart, you’ll notice that the top device is the iPhone XR, which captured 14% of total device activations, followed by the iPhone 11 and then the iPhone 7. As a total series, the X phones captured 29% and the 11 phones captured 26%. The rest, 45%, were spread across older devices.

So why is the XR doing so well? Our hypothesis is that Apple offered a tremendous value with the lowest storage version priced last year at $749. While the XS and XS Max offered a crisper OLED screen, the XR LCD screen was the same that shipped with the 8 and before. Quality differences are hard to discern unless holding the two devices next to each other. The XR also came with the same front camera as the XS, and much of the same rear camera functionality despite having just one camera lens. The XR screen was larger than the XS (but smaller than the most expensive XS Max). The last main difference was storage. Unless you wanted 512GB, you could get the XR with 256GB for $250 less than the equivalent XS and $350 less than the equivalent XS Max.

Now with the 11 series shipping, the XR’s lowest price version has dropped to $599. With incremental changes to the 11 series, mainly around camera and battery life, more value-oriented shoppers continue to reach for the XR. For equivalent-storage devices, iPhone 11 costs $699, iPhone 11 Pro $999 and iPhone 11 Pro Max $1099. This means the XR ranges from $100 to $500 less than the newly available iPhone 11 devices.

The Samsung Flanker

Strategically, we believe Apple sent its solid-quality XR down-market with a much lower price point to disrupt the market share progress of the Samsung Galaxy line. Over the years, Apple has taken the premium segment of the market while Samsung has grabbed more of the middle of the market. As Apple is hitting the upper limit for price points, reaching market saturation, and facing a smaller quality-gap between both Samsung and its own legacy devices, it chose an effective flanking strategy, turning the XR into a fighting brand. This protects its total device base, upon which it is building a healthy services business, compels more price-sensitive iPhone consumers to upgrade from older devices, and holds the line for the higher-end 11 line to continue to own the premium end of the market.

Can Apple’s Christmas go to 11?

Apple is strongly positioned for this holiday season with a one-two punch offered by the XR and the iPhone 11 product line. We speculate that we’ll see a surge in the 11 series on Christmas Day, with the iPhone 11 finally surpassing the XR as the preferred gift to give. Any devices purchased, but intended as gifts, will go live in the market then. However we expect the XR will remain at least the second most activated device for Apple this Christmas, given its unprecedented value. Look for our Christmas Day report during the last week of December to review the final results with us. Until then, happy holidays from Flurry!