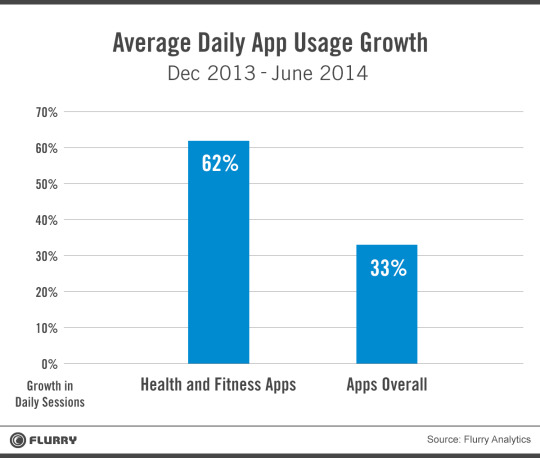

Over the past six years, we have seen mobile and its apps disrupt and transform many industries. The healthcare industry, while named early on as an industry that would be totally transformed by smart devices, seemed to have lagged behind. In 2013 while the overall mobile app industry grew 115% in terms of average daily usage, the health and fitness category only grew 49%. This appears to be changing rapidly in 2014. We are not even halfway through the year (and usage normally accelerates in the summer and during the holidays) and the growth in health and fitness app usage has been stunning. We have studied the usage of over 6,800 iPhone and iPad apps listed in the health and fitness category on Flurry’s platform and we have seen a 62% increase in usage of health and fitness apps over the past six months. This compares to 33% increase in usage, measured in sessions, for the mobile app industry in general. Growth in health and fitness is 87% faster than the industry, which is itself growing at an astounding rate.

We believe many factors that are contributing to this eye-catching growth. First, a glance atwellness and fitness accessories retailed by Apple in the US is a good indication on how many health, fitness and vital sign tracking devices the iPhone can replace. These accessories come with applications that are designed for daily use. Second, there has been a lot of innovation in the apps themselves over the past two years, especially when it comes to integration with Facebook and other prominent social networks. The MapMyFitness application’s integration with Facebook is a great example. Friends can cheer each other on, like and share their achievements and even start competing against each other. This innovation has increased the viral distribution of these apps through the social networking channel. However, we believe that most of the growth in this category is coming from a new segment of mobile consumers which we are calling Fitness Fanatics.

The Fitness Fanatics

In our analysis of health and fitness apps, we analyzed the usage of over 6,800 health and fitness iOS applications in a sample of 100,000 devices. We have computed the time spent by the average mobile consumer in health and fitness apps that are tracked by Flurry. We then analyzed the group of users who spent more than three times the average amount of time in health and fitness apps. We labeled this group “Fitness Fanatics.” We then looked more closely at this segment to better understand the composition of the audience behind it.

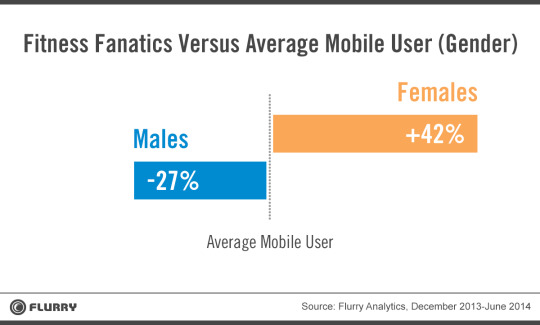

Looking at gender distribution, Fitness Fanatics are 62% females and 38% males. That compares to 48% females and 52% males for the average mobile consumers. This is a 42% over-index on the female side and a 27% under-index on the male side.

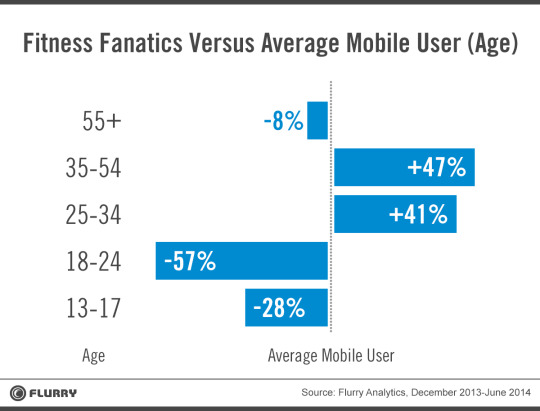

Looking at age distribution, Fitness Fanatics tend to skew older. The 25-34 year-old age group over-indexes 41% compared to the average mobile consumer, and the 35-54 year-old group over-indexes 47%. Teens and millennials under-index by 28% and 57%, respectively.

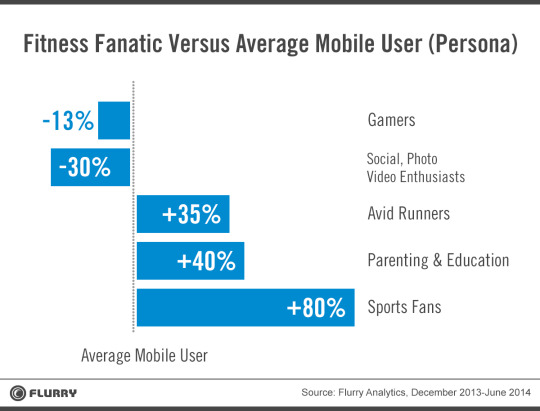

Looking at the Flurry Persona distribution, the chart below gives us a better view into other interests of Fitness Fanatics. They tend to be Sports Fans, Parents, and Avid Runners that pay little attention to social networks and mobile games.

By looking at all three charts, we have a pretty good picture of Fitness Fanatics. They are predominantly mothers age 25 to 54 who are sports fans and lead healthy lifestyles.

Fitness Fanatics and Wearables

The rise of health and fitness apps brings great news to the much-anticipated wearables market. In fact, many analysts and experts perceive health and fitness apps as the killer category for that market. According to Stephanie Tilenius of Kleiner Perkins Caufield & Byers, by 2017, 30% of US consumers will be wearing a device to track food, exercise, heart rate and other critical vital signs. Since Fitness Fanatics are the heavy users of these applications on smartphones and tablets, we expect that this segment will be among the early adopters for wearables, especially watches and bands. This segment will be where Apple (with its newly announced Healthbook) and Google (with its rumored, soon-to-be announced Google Fit) will be paying a lot of attention.

Halfway through 2014, app usage is tracking nicely towards another triple digit growth year and many sectors are growing with it. This year, health and fitness apps are growing faster than the overall market, especially on smartphones. With the wearables market going from prototypes to having mass-market appeal we expect an acceleration of growth in health and fitness apps. With the rumors re-surfacing of an Apple iWatch and a fall 2014 launch date, it looks like Apple has an interesting segment to go after leading into the holidays. We predict 2014 will be a holiday season of commercials made especially for soccer moms.