Some entertainers, like Michael Jackson, become worldwide stars. Others, like Psy of Gangnam Style, capture the world’s attention for 15 minutes. And others stop at the border, never attaining international fame. With games, the same is true. What makes one gaming title spread like wildfire beyond its country of origin to become an international juggernaut, while another is only a local hit? In today’s report, we investigate.

Gaming is the Global Pastime

In this study, we dove deep into global gaming activity to understand which types of games cross borders, and which tend to stay local. For the purpose of this report, we restricted the consideration set to Android devices only, due to its larger market share internationally.

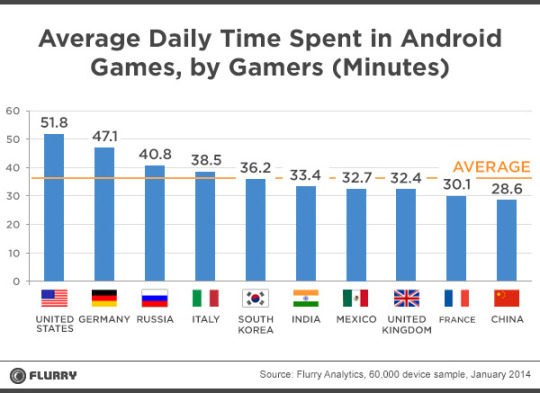

Gaming is truly a global pastime, and Flurry’s data proves it. The chart above displays the average daily time spent in all gaming categories. Globally, gamers are averaging 37 minutes a day playing games. The US leads the pack with nearly 51.8 minutes a day, followed by another leading industrial powerhouse, Germany, with 47.1 minutes. China rounds out the top 10 with 28.6 minutes. It’s a testament to mobile’s global reach that half of the top 10 countries are outside the West. It’s this reach that makes gaming the lingua franca of the modern world.

We Are What We Play

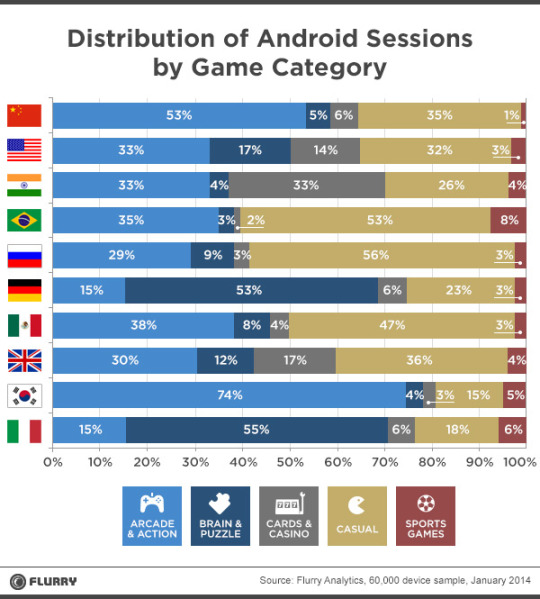

So what types of games are we playing during those 37 minutes (on average) a day? Interestingly, that depends on where you live. The chart below examines the distribution of gaming app sessions by category and country.

Arcade & Action and Casual games command the largest share of all gaming sessions in most countries – Germany, Italy, and South Korea are outliers. In Germany, Brain & Puzzle games, such as social quizzes, account for 53% of all gaming sessions. Similarly, Italians spend 55% of sessions in these apps. In South Korea, people go gaga for Arcade & Action games played through ubiquitous social messaging platform Kakao, with 74% of all gamers playing Arcade & Action titles. In comparison, Sports games and Cards & Casino games generate relatively fewer sessions across the board. It appears that everyone likes a word game, but not everyone wants to play poker.

Favorite Gaming Flavors Differ From Country to Country

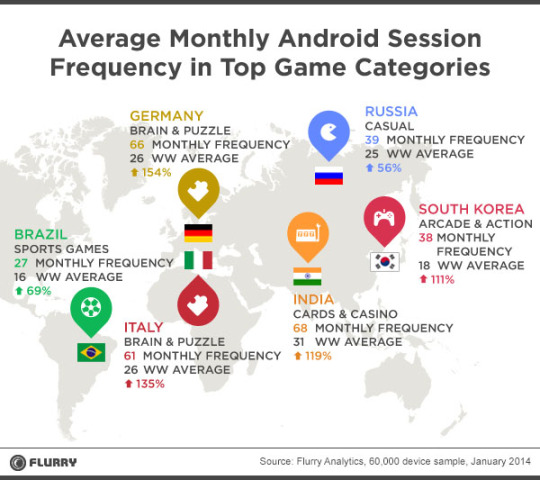

To better understand these behaviors, we looked at the monthly session frequency by category and country. Monthly session frequency is the average number of times a user opens the app in a month. We then compared each country’s average monthly frequency in each category to the worldwide average. Through this comparison seen in the above map we can identify which countries engage in which gaming categories significantly more than the worldwide average. It turns out, Germans love puzzles and quizzes. The average gaming device in Germany has 66 monthly sessions in Brain & Puzzle games, 154% more than the worldwide average of 26. The hugely popular “4 Pics One Word” is from Germany after all.

Indians on the other hand get their kicks in Card Games, generating 119% more card gaming sessions than the global average. For the purpose of this analysis, card games include things like poker- or in this case, the local variant called teen patti (“three cards” in English). Solitaire is also very popular in India. Italians love word games, Brazil is nuts for fantasy football (soccer, that is), Russia goes for classic casual games with a physics element, and South Korea doesn’t play unless the game is on Kakao, and even then it’s simple arcade type games – the cuter the better.

Next Step, World Domination?

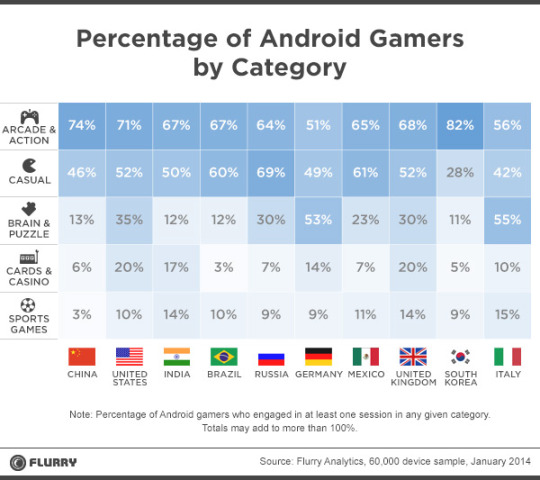

Given these country-specific preferences, what’s a game developer to do? If world domination is the goal, the data suggests it is best to focus on categories with the broadest appeal. The below chart displays the penetration of each category by country, defined as the percentage of gamers playing these categories.

Arcade & Action and Casual are clearly the gaming categories with the broadest appeal. In almost all of the top gaming countries, at least half of gamers engage with these games. For example, 74% of South Korea’s gaming sessions are in Arcade & Action games, but a whopping 82% of gamers in that country play an Arcade & Action game. Russia takes the lead in Casual game penetration, with 69% of all devices engaging in at least one session of a Casual game. Cards & Casino are popular in the US and in the UK, where real money gaming is legal. Sports games appeal to a niche audience, and within that category, the particular sporting interest varies by country. In India it’s all about cricket while in the UK they’re mad for soccer (er, football).

So it turns out that while we all speak the language of gaming, distinct dialects exist. It’s no surprise that international blockbusters like Angry Birds, Hay Day, or Game of War fall into the most-played categories. With the global gaming market expected to reach $24B by 2017, there’s plenty of room for both international standard-bearers and local delicacies alike.