Flurry Estimates 20,000 First Week Nexus One Sales:

Not an Apples to “Apple” Comparison

The Google Nexus One launch has become the most controversial and confusing Android handset launch to date. With publicity “leaks” over the holiday season, the Nexus One handset received unprecedented buzz. This same hype helped create the expectation of a revolutionary Android handset and its potential to be an iPhone killer. To gauge the success of Google’s first handset launch, Flurry leveraged its analytics reach to estimate launch week sales of the Nexus One.

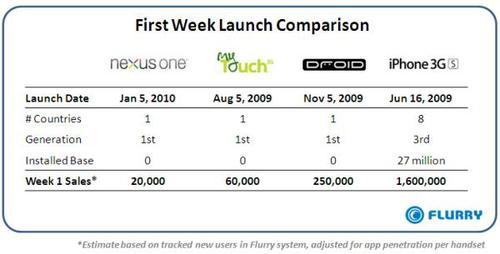

Flurry monitors usage of more than 10,000 developers’ applications on iPhone and Android platforms. In total, Flurry tracks applications on approximately four out of every five iPhone and Android handsets in the market, generating over 25 million end user sessions per day. To estimate first week sales totals for the Nexus One, myTouch 3G, Droid and iPhone 3GS, Flurry detected new handsets within its system, and then made adjustments to account for varying levels of Flurry application penetration by handset. Flurry additionally crosschecked its estimates against Apple actual sales, released for iPhone 3GS, which totaled more than one million units over the three days, June 19 - 21, 2009. Flurry first week sales estimates can be found in the table below.

While Flurry estimates that Nexus One was outsold by Droid by more than 12 times, myTouch 3G by 3 times and iPhone 3GS by a staggering 80 times, it’s worth noting there are significant differences in the marketing, distribution and perception of the device as revolutionary vs. evolutionary. In short, key business decisions and other factors related to the Nexus One launch make an “apples-to-apples” comparison difficult.

As a product, the Nexus One boasts the most advanced Android OS to date as well as unique features, such as Google Voice and Google Maps. However, potentially due to the heightened “promise” created by early buzz, the handset has ultimately fallen short on sales expectations. Without the “wow factor” now expected with each new challenger to the iPhone, especially the first smartphone with Google’s own branding, demand generation has been modest.

Next there is distribution, pricing and marketing to consider. For its release, Google executed an online “soft launch” of the Nexus One, a very different go-to-market strategy compared to Verizon’s launch of Droid, on which it spent a record-breaking $100 million on marketing, including aggressive TV advertising spends. Instead, Google chose to market and sell the device to consumers directly through its own website. While this distribution strategy is among the most innovative facets of the Nexus One launch, and a threat to carrier control of the consumer relationship, a series of customer service and other mistakes reveal Google’s lack of retail experience. Further, Google chose to launch its Nexus One after the holiday season. While selecting this launch time may have been designed to avoid competing unnecessarily with its carrier and OEM partners over the all-important holiday season, this also adversely affected sales.

Additionally, T-Mobile, Google’s carrier partner for Nexus One, did not provide the same carrier co-marketing support as it did for the myTouch 3G launch. Cannibalization may also be playing a role as the Nexus One competes against the myTouch 3G for any new T-Mobile customer. In effect, sales are now split between the two handsets. And while Google, in an effort to avoid channel conflict with T-Mobile, appears to have set the direct-to-consumer price for the handset at over $500 dollars, the high price point combined with the fact that the handset is only considered an “evolutionary” improvement over previous Android devices, indicates that Google did not take the steps to maximize first week sales. This is especially evident when one considers that among the most expensive costs associated with the launch - marketing - has not been incurred, and could have been applied to lowering the direct-to-consumer price point.

With each consecutive Android launch, consumers are enjoying more choices in the market. The flipside of this, however, is that it will take increasing innovation and decreasing price points to attract new smartphone consumers. Further, for Android to continue to chip away at Apple’s third-party app developer support - key to delivering consumers more value - it needs to aggressively grow the Android device installed base. Only then will application developers more fully support Android.