The data in this report is computed from a sample size of over 3,000 applications, 45 million consumers and 4 platforms: Apple (iPhone and iPod Touch), Blackberry, JavaME and Google Android. Each day, Flurry tracks over 15 million end user sessions across apps that have included its analytics solution.

Apple’s Weapon of Mass Consumption: iPod Touch

The highly publicized launch of Droid last month marked a major effort by Google, Verizon and Motorola to slow the iPhone’s growing power in the marketplace. And while the Android platform is the most legitimate challenger to iPhone smartphone dominance, it’s important to remember that the iPhone’s flank is protected by an often overlooked, powerful fighting brand: iPod Touch. According to Apple, 58 million iPhone OS devices have been sold worldwide through September 2009. Of those, Flurry estimates that just over 40%, around 24 million are iPod Touch devices.

While it is clear that the iPhone has significant short-term revenue value for Apple, Flurry believes that the iPod Touch holds more long-term strategic value for Steve Jobs and team. As all industry eyes look to the iPhone, the iPod Touch is quietly building a loyal base among the next generation of iPhone users, positioning Apple to corner the smartphone market not only today, but also tomorrow. In terms of Life Stage Marketing, the practice of appealing to different age-based segments, Apple is using the iPod Touch to build loyalty with pre-teens and teens, even before they have their own phones (think: McDonalds’ Happy Meal marketing strategy). When today’s young iPod Touch users age by five years, they will already have iTunes accounts, saved personal contacts to their iPod Touch devices, purchased hundreds of apps and songs, and mastered the iPhone OS user interface. This translates into loyalty and switching costs, allowing Apple to seamlessly “graduate” young users from the iPod Touch to the iPhone. For OEMs hoping to challenge Apple, we believe an even greater sense of urgency must be adopted.

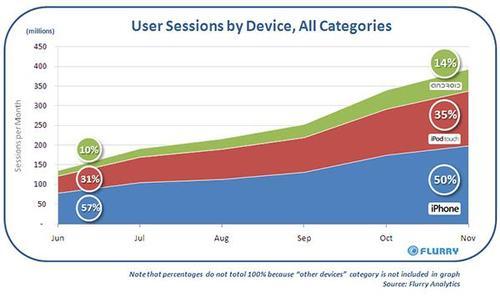

The chart below shows Flurry user sessions tracked across iPhone, iPod Touch and Android for the last six months. Over this period of time, the iPod Touch has gained four points, despite its already large installed base. While iPhone continues to grow in user sessions, its share of sessions has dropped, while iPod Touch and Android have increased as a percentage.

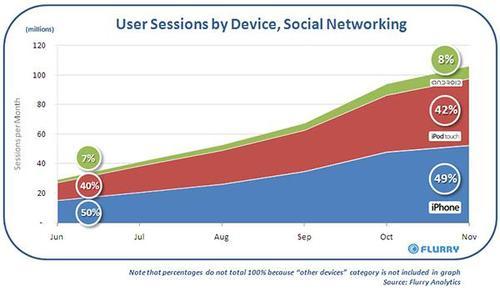

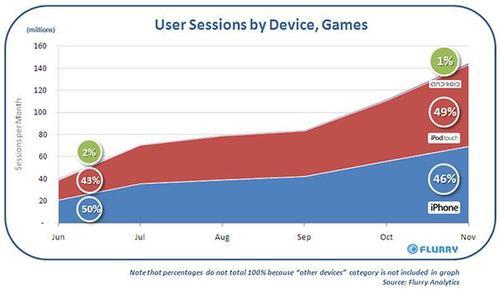

Even more powerful for Apple are the consumption patterns Flurry is detecting among the iPod Touch demographic, demonstrating this segment’s power as a word-of-mouth promotional army. Anecdotally, we know the “iPod Touch Generation” is made up of heavy MySpace, Facebook and SMS users, who voraciously share their lives with, and influence their ever-expanding social graph. Importantly, this also includes promoting products they like. Empirically, Flurry compared how iPod Touch session usage has changed over the last six months across key application categories important to this demographic; namely, Social Networking and Games. While Social Networking’s viral nature is understood, iPhone Games have become increasingly social with the inclusion of features like friends lists, leaderboards and remote multi-player modes. Together, Social Networking and Games category usage reflects the strength of the iPod Touch Generation’s influence among its peers. As this segment increasingly migrates its social habits to smartphones, Flurry data shows that the iPod Touch is the largest beneficiary. The graphs below illustrate how total session growth on iPod Touch for Social Networking and Games categories is outpacing that of iPhone and Android.

Manga Stomps on to iPhone Faster than You Can Say “Godzilla”

The origin of Manga, Japanese comic books, is commonly traced back to the 18th century in Japan. Since then, the Japanese comic book industry has become not only an integral part of Japanese culture, but also a $3.6 billion industry. Visiting Japan today, one can observe people of all ages reading Manga in subways, cafes and other public venues. The export of Manga to other parts of the world first began around World War II, and then accelerated in the 1970s. Among the most recognized figures in Japanese popular culture, Godzilla has also starred in several of his own Manga books.

The iPhone, which debuted in Japan during July of 2008, initially sold poorly for many reasons described by Wired in “Why the Japanese Hate the iPhone” With the release of iPhone 3GS in June 2009, however, Apple has gained hard-fought ground in a market that boasts many of the world’s most advanced smartphones. According to StrategyEye, the iPhone 3GS became the top-selling device in Japan during its first week. Over its first three months, Analysts estimate that well over 1 million iPhone 3GS units were sold in Japan. The result is that the iPhone platform is attracting a wave of support from Japanese developers.

Studying content distribution on the iPhone, Flurry is detecting the rapid infiltration of Manga on the platform. Flurry first described the phenomenon of iPhone as an eReader in an article entitled “After Playing Games, iPhone Gets Serious about Books” in its October 2009 Smartphone Industry Pulse report. Because comic books like Manga lend themselves more to brief sessions of reading than traditional books, especially with their rich graphical treatments, it makes sense that Manga is expanding aggressively to the iPhone.

The graph below shows the number of books released by a major Japanese Manga publisher to the iPhone App Store since July 2009. Note that the rapid release schedule comes just after the successful June 2009 launch of iPhone 3GS in Japan. With an aggressive ramp, this single publisher is already releasing more than five Manga books per day. We can expect this kind of content, well suited for the iPhone to continue to expand faster than Godzilla stormed Tokyo.