Smartphones and tablets have gone from being the latest gadgets for relatively affluent people in relatively affluent countries to ubiquitous devices in mainstream use in many countries around the world. In fact, as we reported in February of this year China surpassed the US to become the country with the largest installed base of connected devices as measured by Flurry Analytics. As we also reported, a second wave of countries around the world is now experiencing the type of growth mobile pioneer countries experienced previously. For example, the mobile markets in the BRIC countries are now all growing faster than the mobile markets in the U.S., U.K., and South Korea.

Knowing that the landscape is constantly shifting, we are beginning a series of blog posts reporting on the use of smartphones, tablets, and apps in particular countries and geographic regions around the world. Given China’s world-leading installed base and considering the China Joy conference (China’s largest digital conference) is this week we thought we would begin there.

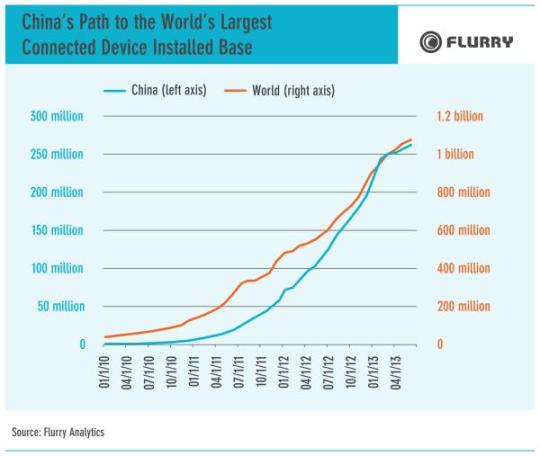

In June of this year Flurry Analytics measured 261,333,271 active smartphones and tablets in China. That represented a whopping 24% of the entire worldwide connected device installed base measured by Flurry. The chart below documents the growth in the installed base. The left axis and blue line show China’s growth over the years. The right axis and red line show growth in the world as a whole (including China) a basis of comparison. As can be seen from the gap between the two lines growing through 2010 and much of 2011, growth in smartphones and tablets in China lagged the world as a whole through that period. But starting toward the end of 2011, the installed base in China began a period of exponential growth. During this period it surpassed the growth rate for the world as a whole, as shown by the blue line catching the red line in the graph. We expect China to maintain its leadership (in terms of active installed base) for the foreseeable future because device penetration rate is still relatively low and much opportunity remains, as we reported in a previous post.

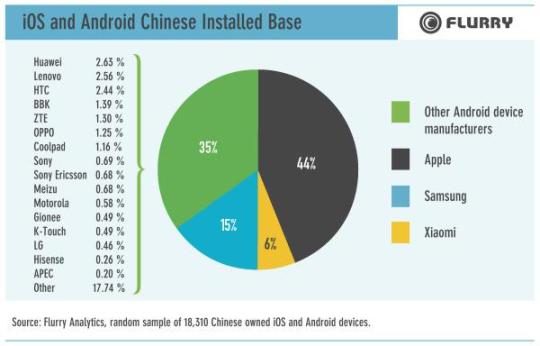

Examining a random sample of 18,310 of the devices in our system in China that run iOS or Android apps revealed that Apple and Samsung are the top two device manufacturers, as they are most everywhere. China’s own Xiaomi was a strong third, with a 6% share of the market, ahead of HTC, Lenovo and a multitude of others. As we noted in a previous post, Xiaomi has been successful in accumulating a large number of active users for each device model it releases. Worldwide, only Apple, Amazon, and Samsung have more active users for each device model released.

It will be interesting to see if Xiaomi can continue to gain share in China – possibly by mopping up share from smaller manufacturers of Android devices – and also if they can begin making gains in other markets outside of China to become more of a global player. With rumors of a Xiaomi tablet circulating, we will also be watching to see if their entry into the tablet market will increase the use of Android tablets in China. Currently 21% of the iOS devices in our randomly drawn sample were tablets compared to only 4% of the Android devices.

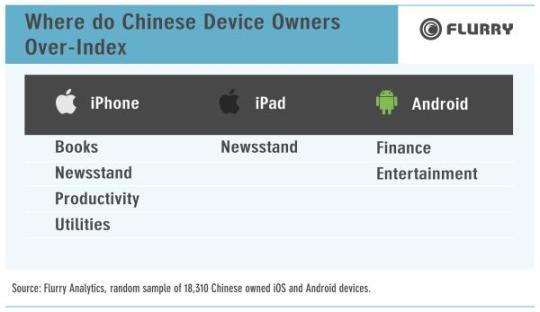

In looking at how Chinese people use their connected devices we see similarities and differences compared to the rest of the world. As a general rule worldwide, games dominate time spent in apps measured by Flurry Analytics, and China is no exception. On average, Chinese owners of iOS devices spent 47% of their app in games. The percentage of app time devoted to games was even greater for Android at 56%.

Smartphones and tablets are not just about fun and games in China. Compared to iOS device owners elsewhere, the average time Chinese owners spend using Books, Newsstand, Utility, and Productivity apps is greater than the rest of the world (1.8x, 1.7x, 2.3x, and 2.1x respectively). On average Chinese owners of Android devices spend more than seven times as much time in Finance apps (7.4x) than Android owners elsewhere spend in Finance apps, but they also spend more time in Entertainment apps (1.7x).

It will be interesting to see how China now having leadership in terms of its installed base will impact the device and app markets elsewhere. Given Xiaomi’s success at building a large number of users for each model it releases, it might try to add further scale by expanding internationally – particularly to the other rapidly-growing BRIC markets where brand preferences are not already well-entrenched.