December 5, 2014 | Simon Khalaf

Over the past few years, we have seen mobile and apps invade the American living room and displace television as America’s favorite pastime. While there is a general agreement that mobile apps are taking minutes from other entertainment channels including television, there hasn’t been much analysis on how dollars are shifting from TV to apps: subscription dollars, advertising dollars, or otherwise. We have conducted an analysis to figure out how consumer dollars have moved and the short answer is: not much. At least not yet.

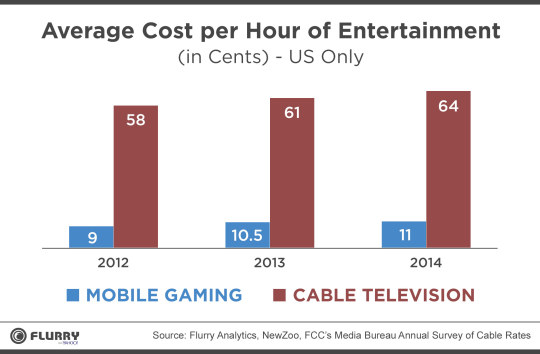

Apps: Still a Bargain Compared to Cable TV

In our analysis, we calculated the costs an average US consumer is paying per hour of entertainment for cable television and for mobile games. Because it’s the most mainstream and best monetized mobile category, we used mobile games as a proxy for the overall media and entertainment category on mobile. On average, in 2014, an American consumer is paying 64 cents per hour of entertainment on cable TV, compared to just 11 cents on mobile games. That is a whopping 5.8 times or 482% more for an hour of cable. It is true that both are still dramatically cheaper than an average of $5 per hour of entertainment at the movie theatre (assuming a $10 USD movie ticket and a 120 minute movie), but you rarely find Americans going to the movies on a daily basis. The picture wasn’t very different in 2012 and 2013, in which the average American consumer paid 6.4 and 5.8 times more on cable television than mobile games, respectively.

In our analysis, we used data from the FCC Media Bureau’s Annual Survey of Cable Rates, and used the “Expanded Basic Service” as our baseline for average monthly costs of the cable bill. For mobile gaming numbers, we used data from Flurry Analytics as well as data released by Newzoo about mobile gaming revenues in the United States. In order to get an apples-to-apples comparison, we broke down all the costs to an hourly rate for both channels of entertainment.

Hours, and Dollars, Spent in Gaming on the Rise

It may seem odd that between 2013 and 2014 the average consumer only paid one-half cent more on mobile gaming, especially when the market is expected to grow to approximately $4.2B in 2014 from $3B the year before, so let me clarify a couple points on mobile gaming. First, with the rapid growth of smartphones and tablets, the number of mobile gamers in the US has increased from 94M in 2013 to 108M in 2014. Second, the time-spent in gaming apps increased from approximately 50 minutes in 2013 to approximately 56 minutes in 2014 (a 12% increase). So while the overall market is expected to grow by $1.2B, the per hour cost only grew by 4.7% from 10.5 cents to 11 cents. But, more users spending more hours in games adds up to big bucks.

Many analysts will argue that the costs of production of TV content is dramatically higher than the cost of production of mobile games and hence the price difference. Well, that all depends on the TV show and also on the type of game. In fact, the cost of mobile game development and promotion has gone up over the past few years as gamers had to improve the quality of their games and spend more on marketing their titles among fierce competition in app stores. A quick look at Candy Crush maker King’s Q3 2014 earnings announcement reveals $42M USD spend in R&D and a further $100M spend in sales and promotion costs. It was unheard of a couple years ago to see apps advertising on TV, while now it is commonplace.

A Pay-For-Content Model that Works

The chart above could easily serve as a wake-up call for the cable TV industry which is taking a slow and conservative approach to unbundling. On the flip side, it can serve as a great reminder of the opportunity that is still ahead of app developers in general, and emerging media and entertainment companies, as well as game developers, in particular. Even if the price of cable television comes down, it will not come down 5.8 times. The most likely scenario is that app content (games, media, music and entertainment) will get better and command a higher price. The good news for the mobile app industry is that, unlike the desktop web, consumers are already paying for content, mostly in the form of in-app purchases and subscriptions. And compared to cable television rates, there is room to grow.