This month, the world’s two largest mobile app platform providers, Apple and Google, enter what is arguably the most critical month of the year for each company, when each hosts their annual developer conference, the Apple Worldwide Developer Conference (WWDC) and Google I/O. While engaged in a multi-year platform war, their success largely depends on innovation provided for their platforms by the third party developer community. If the developer community embraces one platform over the other, developers will build the software that infinitely extends the value of the consumer experience, giving a platform a meaningful edge. The perceived availability of a large, steady stream of high quality apps is a key reason for consumers to initially choose an Android or iOS device, and then to remain loyal. Moreover, given that the mobile industry is among the leading sectors in the worldwide economy, the outcome of these two conferences can largely impact the fate of some of the most prolific, innovative forces in the world’s economy today. Combined, Apple and Google have a market cap of approximately three quarters of a trillion dollars.

This report compares developer support for iOS versus Android and explores the underlying factors that could explain varying levels of developer loyalty. We use the data set collected by Flurry Analytics, now powering consumer insights for more than 70,000 companies across more than 185,000 mobile apps. Each day, Flurry tracks more than 1.2 billion anonymous, aggregated end user sessions across more than 100 million unique devices. Each month, Flurry tracks over 36 billion end user sessions across more than a 500 million devices, a number that is more than 60% of Facebook’s monthly active user base.

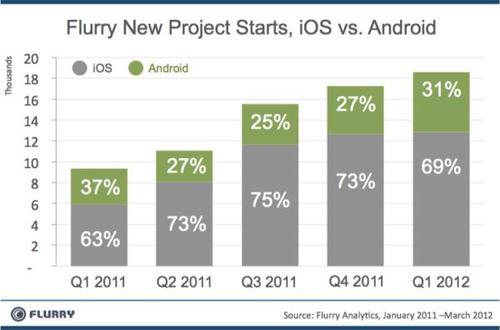

At Flurry, we track developer support across the platforms that compete for their commitment. When companies create new projects in Flurry Analytics, they download platform-specific SDKs for their apps. Since resources are limited, choices developers make to support a specific platform signal confidence, as they invest their R&D budget where they expect the greatest return. Further, because developers set up analytics several weeks before shipping their final apps, Flurry has a glimpse into the bets developers are making ahead of the market.

The chart above shows that Apple continues to garner more support from developers. For every 10 apps that developers build, roughly 7 are for iOS. While Google made some gains in Q1 2012, edging up to over 30% for the first time in a year, we believe this is largely due to seasonality, as Apple traditionally experiences a spike in developer support leading up to the holiday season. Apple’s business has more observable seasonality.

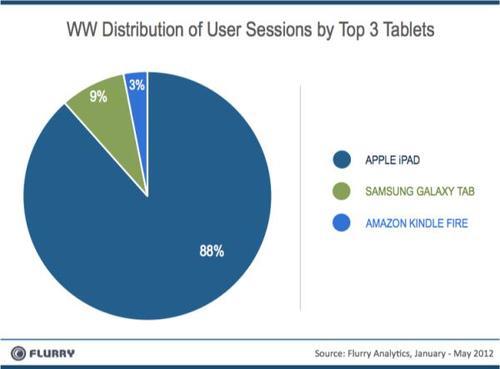

Among the reasons iOS appears more attractive to developers is the dominance by Apple in the tablet category. Not only does Apple offer a large, homogenous smartphone base for which to build software, but also when developers build for smartphones, their apps run on Apple’s iPad tablets as well. That’s like getting two platforms for the price of one. Apple offers the most compelling ‘build once, run anywhere’ value proposition in the market today, delivering maximum consumer reach to developers for minimal cost.

The pie chart above demonstrates just how much Apple dominates the tablet category. The Galaxy Tab and Amazon Kindle Fire hold very distant second and third places in terms of consumer usage. To build the chart, Flurry aggregated total worldwide user sessions across the first five months of the year, January through May.

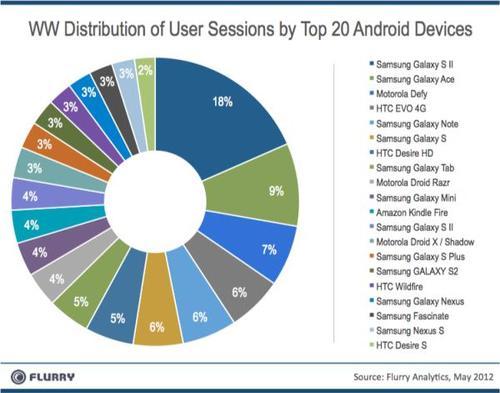

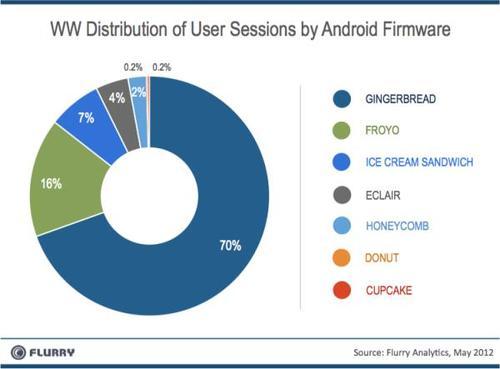

Opposite to the efficiency Apple offers developers through their homogenous device base, Android fragmentation appears to be increasing, driving up complexity and cost for developers. Further, this fragmentation is concentrated primarily in just smartphones, as there is no serious Android tablet contender to the iPad. For Android, Flurry observes fragmentation along two significant vectors, devices and firmware. Let’s look at device fragmentation first.

The chart above shows the number of consumer application sessions across the top 20 Android devices in May 2012. Four major OEMs – Samsung, Motorola, HTC and Amazon – have Android devices in the top 20. 17 of the top 20 hold a share of 6% or fewer, among the top 20, meaning that each additional device a developer supports will deliver only a small increase in distribution coverage. However, on Android, both devices and firmware contribute to fragmentation, so let’s look at firmware fragmentation next.

The above chart reveals that the majority of devices in the market run Gingerbread, which is only the third newest iteration of the Android OS. Honeycomb, more optimized for tablets, and Ice Cream Sandwich, which put a lot of effort into the user interface, have a combined 11% of penetration in the market. Froyo, which shipped before Honeycomb and Ice Cream Sandwich, alone has a higher share of firmware penetration than the two newer, more advance firmware versions combined. This means that the majority of consumers are running on an Android operating system that is three to four iterations old.

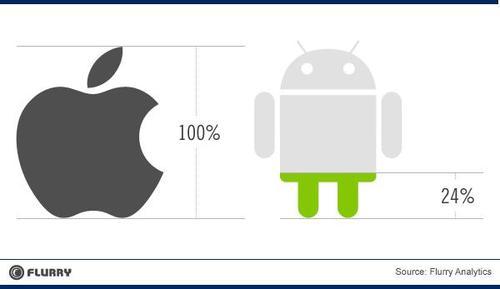

Running a comparison of revenue generated by top apps on both iOS and Android, Flurry calculates that the difference in revenue generated per active user is still 4 times greater on iOS than Android. For every $1.00 a developer earns on iOS, he can expect to earn about $0.24 on Android. These results mirror earlier findings from similar analysis Flurry conducted in Q4 of 2011 and Q1 of 2012.

At the end of the day, developers run businesses, and businesses seek out markets where revenue opportunities are highest and the cost of building and distributing is lowest. In short, Android delivers less gain and more pain than iOS, which we believe is the key reason 7 out of every 10 apps built in the new economy are for iOS instead of Android.

Over the next two weeks, the momentum of two of the world’s most innovative, influential and prolific technology companies will be impacted by the reaction of the development community to their conferences, Apple WWDC and Google I/O. And as developers watch Apple and Google, the world should watch developers.