At the recent Le Web conference in France, Google Chairman Eric Schmidt declared that “Android is ahead of the iPhone now.” According to Schmidt, Android’s success is due to “unit volume, Ice Cream Sandwich,” because “the price is lower” and because “there are more vendors.”

Google announced last week that worldwide Android Market app downloads now exceed one billion per month. Compared to iOS, which surpassed 18 billion total downloads in October, Google revealed that the Android Market recently surpassed 10 billion total downloads. This comes on the heels of comScore’s latest MobiLens report, showing that, for the three months ending in October, Android devices now account for 46.3% of U.S. smartphone subscribers versus 28.1% for Apple. By these accounts, Google Android has momentum. Mr. Schmidt further predicted at Le Web that, within six months time, Android would become the first platform for which developers build.

At Flurry, we track developer support across the platforms that compete for their commitment. When companies create new projects in Flurry Analytics, they download platform-specific SDKs for their apps. Since resources are limited, choices developers make to support a specific platform signal confidence, as they invest their R&D budget where they expect the greatest return. Further, because developers set up analytics several weeks before shipping their final apps, Flurry has a glimpse into the bets developers are making ahead of the market.

In total, over 55,000 companies use Flurry Analytics across more than 135,000 applications. For this report, we study new project starts for 2011, during which developers set up analytics for approximately 50,000 apps.

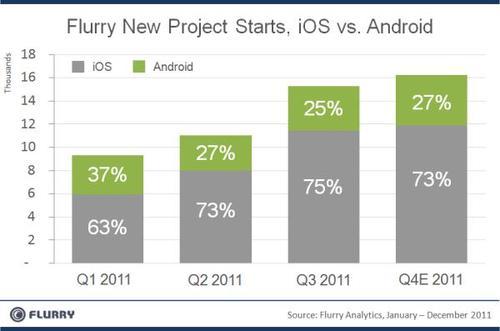

The chart shows the number of applications integrated with Flurry Analytics during 2011, by quarter, starting with Q1 on the left, and finishing with Q4 on the right. The percent of new projects created for iOS is represented in grey. Google Android’s share of new projects is shown in green. Note that we estimated the remainder of December based on the first third of the month’s data already collected. We further estimate that Flurry Analytics powers approximately 25% of all apps downloaded from the App Store and Android Market combined.

Over the year, developer support for Android has declined from more than one-third of all new projects, at the beginning of the year, down to roughly one-quarter by the end. While the market nearly doubled for both platforms, we believe key events changed the proportion of support between these two platforms. Of particular note, Apple expanded distribution for iOS devices beyond its long-standing exclusive with AT&T to include Verizon in February and Sprint in October. Further, the highly successful launches of iPad 2 in February and iPhone 4S in October resulted in increased developer support for Apple. By contrast, Android does not enjoy a truly recognizable flagship device among its army of OEMs supporting the platform.

In particular, the market expanded aggressively in Q3 in anticipation of iPhone 4S support and the upcoming holiday season. Flurry saw a similar boom in developer activity, ramping up to the holidays, in both 2009 and 2010. And while allegiance to iOS has been more tilted toward Apple in previous years, new project starts for iOS still outnumber those for Android approximately three-to-one.

Now let’s return to Google’s position that “Android is now ahead of iPhone.” In terms of the number of devices activated per day by consumers, this is indeed the case. In November, Google released that 200 million total Android devices have been activated with 550 thousand now activated daily. In October, Apple announced that over 250 million iOS devices had been activated, and Flurry estimates that more than 450 thousand are activated daily. With converging installed base numbers, and Android now edging out iOS for daily activations, the key question remains: Why are developers still supporting iOS three times more than Android?

Android ecosystem challenges have been widely publicized, from OS fragmentation to concerns about the impact of not curating the Android Market. However, the largest single factor that appears to impact developer support for the platform is the consumer’s ability to pay. This comes down to Google Checkout penetration. Upon setting up an iOS device, a consumer must associate either a credit or gift card to her iTunes account. In theory, this means that 100% of all iOS device users are payment enabled. This has not been the case for Android, resulting in lower revenue generation possibilities on the platform. With the recent integration of Google Wallet and Google Checkout, as well as their current $0.10 Android app sale to spur new account sign-ups, Google appears to be taking steps to correct this.

While exact Google Checkout penetration is unknown, the respective revenue generated by each platform for same apps, provides the morale of the story: Despite installed base numbers and daily activations, the almighty dollar still drives business decision making among application developers. And with the critical holiday season upon us, developers are betting on iOS for Christmas 2011.