In 1985, Microsoft introduced the Windows operating system for personal computers. Leveraging a more open partnership model, Windows overtook the operating sytem market, with market share now exceeding 90%. As the 80s drew to a close, IBM had faltered as the world’s most valued brand in computing, leaving an opening for the combination of Windows and Intel, aka “Wintel,” to be associated with value to consumers.

In October 2008, T-Mobile released the G1 by HTC, the first commercially available mobile device running on the Android operating system. For consumers, this marked the first opportunity to use a new kind of handset born of the Open Handset Alliance, a Google-led collaboration of now more than 79 member companies who pledged to support open standards for mobile devices.

With OEMs such as HTC, Motorola, Samsung and LG all adopting the Android OS, the race is on to earn a Wintel-like place in the hearts and minds of consumers. In this report, Flurry reviews the first two years of the Android device market and concludes that the combination of Samsung and Android, or “Samdroid” as we are coining it, has emerged as a new leader in non-iOS smartphones.

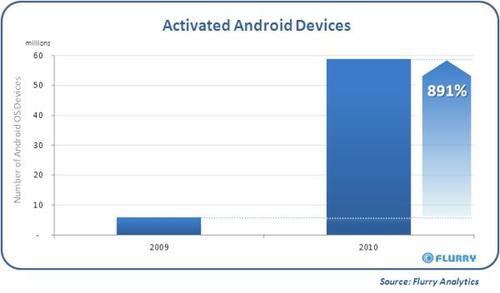

Android Growth Explodes in 2010

Through its analytics service, Flurry estimates it detects over 80% of all Android devices. Presenting our own count of Android devices from 2009 to 2010, without any adjustment, the chart below shows how the launch of wave after wave of increasingly more powerful Android devices has resulted in unprecedented year-over-year growth. By our count, devices running on Android OS now exceed 60 million. From 2009 to 2010, Android adoption increased by nearly 10 times, from 5.9 million to 53 million devices.

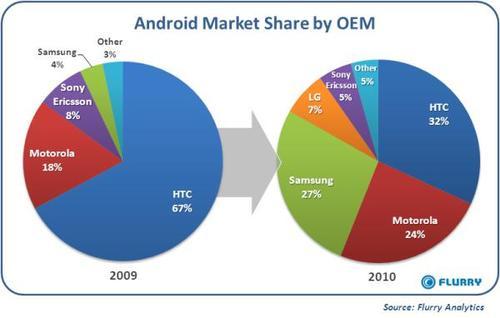

The New 2010 Android Landscape

In 2009, the leading Android handsets were the T-Mobile G1 by HTC, myTouch 3G by HTC and Motorola Droid. Overall, for 2009, HTC’s early commitment to Android was rewarded. By the end of 2010, however, three companies split the majority of share for Android devices, with Samsung coming on very strong in the second half of 2010. Additionally, LG captured 7% of Android device activations with a surge of Q4 sales. As a new brand in consumer electronics, HTC appeared unable to withstand erosion of its early, dominant market share lead against mature brands like Motorola, Samsung and LG.

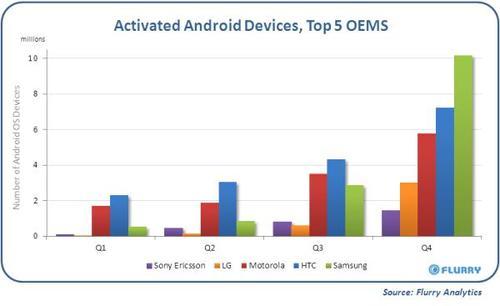

Samsung Disruption in Q4 2010

Breaking out new Android device activations by OEM by quarter in 2010, as is done in the subsequent chart, provides a view into how Samsung enters strongly in the back half of 2010. In fact, Q4 2010 marked the first quarter since Android launched eight quarters ago in Q4 2008, with the T-Mobile G1 by HTC on T-Mobile, that HTC did not lead the market in quarterly new Android activations. While HTC enjoyed strong first-mover advantage, coupled with additional penetration through its willingness to white label for Google and T-Mobile branded Android devices, it succumbed to the brand power of Samsung led by its Galaxy S line of Android devices in Q4 2010.

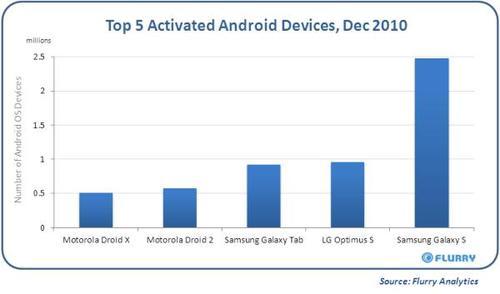

The Galaxy is out of this World for Holiday 2010

Studying the Holiday period in December 2010, not only does Samsung dominate the top position with the Galaxy S, but also claims the third best spot with the Galaxy Tab, the best-selling Android tablet and only non-phone in the top ten. Additionally noteworthy is that the top five does not include HTC. However, it’s also fair to point out that by expanding the list to include the top ten devices, spots six through ten are all HTC devices, in the following order: HTC EVO 4G, HTC Desire, HTC Incredible, HTC Glacier and HTC Wildfire.