According to the U.S. Census Bureau, more than 12% of people in the U.S. speak Spanish at home, and nearly fifty million Americans are of Hispanic origin. The collective purchasing power of Hispanics is expected to reach 1.5 trillion dollars by 2015. Brands are clearly aware of the importance of this demographic group, and there are advertising agencies dedicated towardhelping brands communicate with Hispanic consumers. Nonetheless results of some recentresearch suggest that brands are not doing enough to create positive app experiences for Spanish speaking consumers in spite of the fact that Hispanics in general are enthusiastic users of smartphones.

Last week’s Advertising Research Foundation forum on the intersection between mobile and culture inspired us to investigate what the overall U.S. appscape looks like from the perspective of Spanish-speaking device users. Flurry is able to do that because we can detect what language a user’s device is set to each time they start an app session, and we record data from over a billion app sessions each day in the U.S.

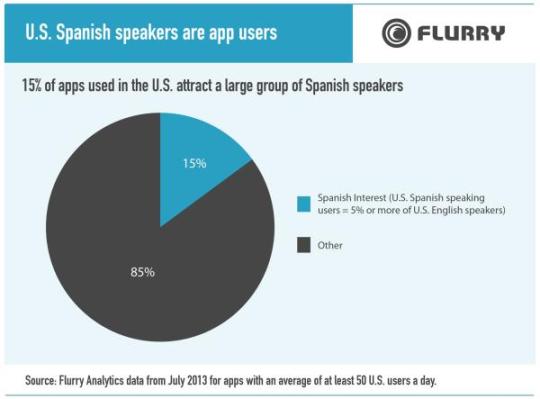

We started by defining Spanish Interest apps as those for which there is at least one U.S.-based user with their device’s language set to Spanish for every twenty set to English. We used this as an indication that a non-trivial proportion of the app’s users speak Spanish, indicating some level of interest in the app among Spanish speakers. As shown below, 15% of apps with fifty or more daily users in the U.S. were in this category.

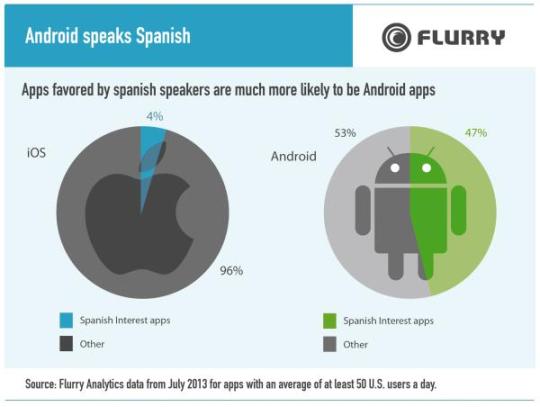

The overall percentage of Spanish Interest apps is in line with what you might expect given the prevalence of Spanish speakers in the U.S., but what’s surprising is how those apps are distributed across mobile operating systems. As shown below, nearly half of Android apps are Spanish Interest apps compared to less than 5% of iOS apps. In other words, 47% of Android apps have one or more user with their device set to Spanish for every twenty who have it set to English. That is only true of 4% of iOS apps.

It’s important to note that this may not be so much a reflection of app availability as it is a reflection of device ownership patterns since the apps a user can run are determined by their device’s operating system.

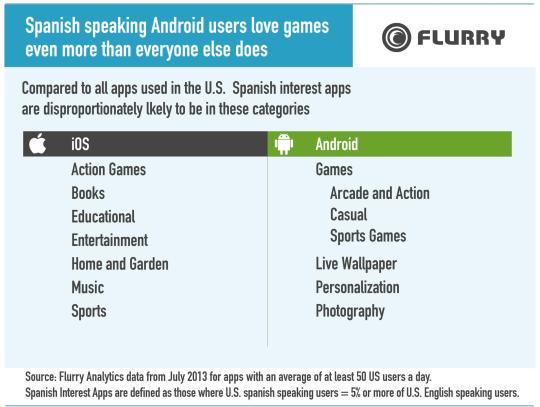

The apps that have the greatest number of U.S. users with devices set to Spanish as compared to English are mainly Spanish language apps (some originating from the U.S. and some from countries for which Spanish is the dominant language). Other than that, Spanish Interest apps span the full range of app categories but are disproportionately likely to be in the Game, Live Wallpaper, Personalization, and Photography categories in Google Play. As shown below, Spanish Interest apps are also over-represented in some iOS categories, but because the base rate on iOS is so low (4%) the absolute percentage of Spanish Interest apps is still relatively low even in categories in which they are over-represented.

By definition, the audience for Spanish Interest apps includes Spanish speakers, but we wanted to find out what else we could learn about the audience for those apps. We did that by identifying which Flurry Personas (psychographic segments) are over- and under-represented in Spanish Interest apps. We found that Pet Owners, Sports Fans, and Value Shoppers are among the over-represented Personas and Auto Enthusiasts, Home and Garden Pros, and Real Estate Followers are among the under-represented. A more complete list is provided below.

Many brands have taken a while to embrace mobile at all, and to the extent that they have they have tended to start with iOS. Some haven’t ventured any further. In some cases that is due to concerns about fragmentation or for brand safety in the more open Android ecosystem, but it is also due to the demographics of the user bases for iOS and Android. A considerable body of evidence suggests that, on average, iOS users are more affluent than Android users and they tend to spend more money in a variety of product categories.

Combine that with the tendency of Spanish Speakers to use Android devices, and it’s easy to understand why few brands have created Spanish language apps. The fact that some of thePersonas most coveted by advertisers are under-represented in the apps in which Spanish speakers are most over-represented reinforces this point.

Given the size of the Spanish speaking population, the shift of consumer attention toward mobile, and the advertising budgets following them, this situation needs to change. Our results show that if marketers want to reach Spanish speakers on mobile they are going to need to do so using Android. That creates an opportunity – or really a necessity – for Hispanic-focused advertising agencies to lead in creating high-quality brand promotion on Android. While Android users in the U.S. may be less affluent than iOS users, collectively they still have massive purchasing power, and world-wide, Android is even more dominant than it is in the U.S. Given the size of the Android audience world-wide, teaching brands to speak Android could pay big dividends well beyond those that can be generated from U.S. Spanish speakers.