In just two years, tablet computing has gained unprecedented traction. According to research firm Strategy Analytics, global tablet shipments more than doubled during the last three months of 2011, rising to 26.8 units, up from 10.7 million a year earlier. And while Apple continues to dominate the tablet category, having sold a record 15.4 million units during the final quarter of 2011, Android OS tablets have increased their share of the tablet category, growing from 29% in Q4 2010 to 39% in Q4 2011.

The increase in market share is due largely to the entry of the Kindle Fire by Amazon. With Flurry in tens of thousands of Android apps, including many of the most popular, the company estimates that it tracks over 20% of all consumer sessions on more than 90% of all Android devices each day. A session is defined as the launch and subsequent exit (or pause for more than 10 seconds) of an app. For example, a consumer may play a game in one sitting for five minutes. Let’s take a look at the data.

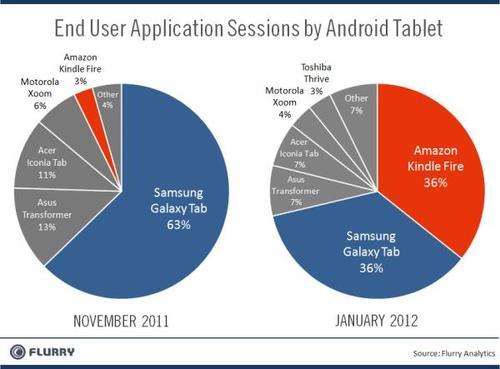

The chart above compares application sessions among all Android tablets before and after the holiday season. For January, we use month-to-date figures, at the time this report was written. Since we’re looking at proportions of use, estimating the remainder of January would not change percentages. For an easier visual comparison, we label Amazon Kindle Fire in orange and Samsung Galaxy Tab in blue. On the left, in November, we see that Samsung Galaxy Tab dominated application session usage on Android, with the Kindle Fire only having recently launched. At that time, the Samsung Galaxy Time was widely considered the only viable competition to the iPad, though a distant second. In January, after the holiday boom in devices and in apps, we see that strong adoption of Kindle Fire, combined with significant downloads driven from the Amazon App Store, resulted in a massive surge in session usage that just edges out the Galaxy Tab. Unrounded, Kindle Fire represents 35.7% of sessions and Galaxy Tab represents 35.6%. Remarkably, and from a standing start, the Kindle Fire overtook the Galaxy Tab in just a few short months. Total Android tablet sessions in January more than tripled over November, with Galaxy Tab sessions increasing by more than 50%. Overall, Android Tablets are growing aggressively as a category.

So how can a late entrant like Amazon, with little-to-no hardware DNA, waltz in and knock off a consumer electronics juggernaut like Samsung, a company that also enjoyed strong growth in 2011? This is where we believe things get interesting. In short, Amazon’s launch of Kindle Fire had more in common with an Apple-style launch than it did with aligning with the Android system. To date, the Android world has focused on marketing the operating system and the “power” of the devices, with quality of content and the consumer experience subordinated in priority. With Google managing the Android Market, which lacks content control and a seamless commerce experience, inertia pushes those developers who choose to build for the platform toward advertising models. Developers who monetize through other means tend to make less on the platform. To ensure that it could take full advantage of its unique digital store prowess, Amazon forked the Android operating system.

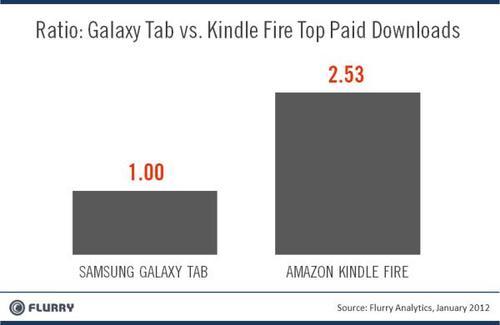

Apple, on the other hand, understands that great content is the key to increasing the attractiveness of hardware. They learned this hard way during the 1980s when an inferior combination of PC hardware and operating systems overtook Apple computers, primarily due to a lack of software. This time around, for the iPhone and iPad, Apple created a robust economy in which developers could thrive, ensuring their allegiance to innovating for the Apple platform, ultimately making Apple hardware more desirable, and creating a rare, but powerful virtuous cycle. To understand how well Amazon might attract developer support, we studied how well Amazon drives paid downloads in its store versus the Android Market through the Kindle Fire and Galaxy Tab, respectively.

To build this chart, we gathered download data from a “basket” of 5 paid apps that ranked in the top 10 apps in both the Amazon App Store and Android Market during January 2012. We then compared how many of these paid downloads were downloaded to the Galaxy Tab versus the Kindle Fire. From our analysis, we found that the Kindle Fire drove over 2.5 times more paid downloads to consumers than the Samsung Galaxy Tab. This shows that for tablets, the Amazon App Store can already deliver more direct revenue to developers than the Android Market. Even more impressive is that the Galaxy Tab, launched in November 2010, has a much larger existing installed base than the newly launched Kindle Fire. Flurry estimates that the active number of Galaxy Tabs in the market is at least twice that of the Kindle Fire.

Amazon’s go-to-market strategy for the Kindle Fire is ground breaking among the Android guard. With its offering, Amazon takes the focus away from the device and operating system, emphasizing content, a differentiated consumer experience and commerce. For its launch, it lined up key content such as Facebook and Angry Birds, as well as offering Amazon Prime, its own streaming TV and movie service. Beyond leveraging its cloud and e-commerce infrastructure, Amazon controls its own store, commanding among the largest aggregations of consumer credit card accounts on the planet. Upon launching the Kindle Fire, consumers must either link to their Amazon account or enter credit card information. This makes the user base 100% payment enabled.

Amazon’s approach to the distribution of digital content is the ultimate razor-razorblade model, where the “stalk” (tablets) is given away for as little as possible and profits are made from the sale of razors (content). Understanding that Amazon is a high volume seller of goods, now becoming ever more digital than physical, sheds light on why they embrace the end-user experience and the religious focus on making the sale of content compelling and easy. Further, it shows us why launching with an aggressive low price penetration strategy for their hardware, priced at $199, was critical to its strategy.

Amazon, who once moved the world from buying goods at retail to buying them online and having them shipped to doorsteps, is now distributing the new form of mobile store via tablets. In a move that reduces the possibility of its own disintermediation, Amazon’s distribution model starts with its own roots: books, music and video (aka “BMV”). Through this move, Kindle Fire is changing the rules of engagement on the Android platform to shape the playing field into one where they, the consumer and the developer win.