Many app developers may not know it yet, but the modern app ecosystem is about to change in a very big way.

And it may be quite a shock to many how drastically that change will impact their bottom line.

Last summer Apple announced its App Tracking Transparency (ATT) framework that has the potential to negatively disrupt the way app makers monetize their software. The technical changes will reduce the kind of default data access that app developers have to identify users.

These changes will make it harder to target ads to specific users and will make app-based ads less appealing to demand-side platforms.

This means that the faucet of money that has kept many ad-supported apps awash in capital is expected to be turned down to a trickle when ATT goes live. As a result developers that rely on advertising are going to have to pivot in many ways to profitably survive.

As the decision-makers and dev team at Apple get the latest version of their mobile operating system ready for prime-time, app developers need to get ready for the seismic shift that will almost surely occur in the app ecosystem when ATT launches. Here’s what app developers need to know to prepare their software and their business for the fallout.

What Apple’s changing with App Tracking Transparency

Industry watchers, analysts, and pundits have variously referred to the impending changes in iOS as an apocalypse, death of the in-app advertising industry, or at very least a serious curveball.

So what exactly are the changes that Apple’s enacting?

At the crux of it is a change in rules about how developers collect and share user information with advertisers.

The salient points all have to do with a special tracking number called the Apple Identifier for Advertisers, or the IDFA. IDFA is a device identifier that Apple assigns to users which can be collected by the developer and shared with advertisers for the purpose of tracking and targeting consumers with ads without directly identifying the user’s personal identity.

The problem for consumers is that IDFA tracking can still feel invasive to many, and may reveal a lot about their app choices and digital persona that they’d prefer not to have broadly shared. This privacy concern is particularly complicated due to the complex thirdparty and fourth-party relationships in the advertising supply chain.

While Apple isn’t necessarily getting rid of IDFA, what it IS doing is switching the broadcast of this data from consumers to publishers from an opt-out to an optin model. This means after ATT launches sometime in 2021, app users will have to give individual apps permissions to access their IDFAs.

Key takeaways

- Apple identifier for advertisers: IDFA is a device identifier that Apple assigns to users which can be collected by the developer and shared with advertisers for the purpose of tracking and targeting consumers with ads without directly identifying the user’s personal identity.

- Opt-out to opt-in model: After Apple’s App Tracking Transparency launches sometime in 2021, app users will have to give individual apps permission to access their IDFAs.

How the change will impact consumer behavior

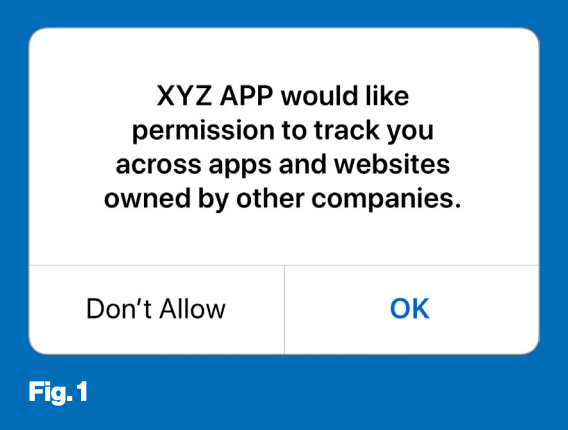

In the past a consumer had to dig pretty deep into a phone’s privacy settings to turn off IDFA use by their apps. Now, when an ad requests access to an app that uses IDFA, they will get a pop-up, see Fig. 1.

A consumer has to make a conscious choice to enable IDFA based on that pop-up. And more likely than not with that kind of scary looking pop up, the broad majority of consumers are likely going to say no thanks. Based on our experience with GDPR and similar privacy controls, we anticipate opt-in rates will be at or below 20%.

Why Apple’s changing the game

Ostensibly this maneuver is for privacy protection of consumers, though there are arguments to be made that this is a broader turf war between Apple, Google, and Facebook. However, one thing is clear.

While this move makes sense for consumer privacy in a lot of ways, it could really make it difficult for developers to continue operating without making some drastic changes to their monetization models. If it moves forward as planned, this IDFA shift will drastically change the face of the app economy.

How modern ad-supported app development works

Before we dig into how the IDFA opt-in policy change is going to impact the app publishing world, let’s take a moment to discuss the state of the industry today. This should provide some context to understand the ramifications that will come when Apple launches this App Tracking Transparency framework.

A lot of the explosion in app development today has occurred on the back of an increasingly robust in-app advertising economy. Consumers have come to expect easy, diverse access to games, productivity software, news apps, and more that are funded in large part by a range of in-app advertising.

Without in-app advertising, the app developer world would not have been able to innovate and provide the same level of free choices to consumers. Meanwhile, advertisers and marketers have grown to love this channel because it is much more targeted compared to traditional media advertising channels.

“Why exactly is it that marketers buy programmatic in-app ads?,” explains Forrester Research, “About three-quarters of respondents say it is because the medium offers better customer engagement and better targeting abilities. This is the case for both in-app ads generally and in-app videos specifically.”

IDFA stands at the nexus of this entire modern ad-supported app ecosystem, because it provides the means (at least on the Apple platform) for supply-side publishers to relay information about users back to demand-side advertising platforms and exchanges. This makes tracking, attribution, ad targeting, retargeting and more very easy to accomplish.

The lack of IDFA visibility will make it much more difficult to achieve that kind of targeting.

Networks and demand-side platforms use the IDFA to reach target audiences. Going forward, when the IDFA becomes largely unusable, advertisers will no longer know which consumers they’re reaching. As a result, ad spending will drop, leading to lower CPMs and fill for application publishers.

State of Ad-Supported Apps Pre-ATT

IDFA changes put a lot of the following at risk

- App install in-app ad spending: $57.8 billion in 2019

- Total mobile ad spend: $87.3 billion

- In-app advertising’s share of spending: ¼ of 2019 digital spend

- Allocating more than half or more of mobile ad spend on in-app channels: 57% of marketers

- Believe targeting is the most important criterion for choosing an in-app publisher: 73% of media buyers

Developers should be prepared for the following fallout scenarios

Drastic cut in ad-supported revenue:

Spending will go down and ad efficiency will go down. Nobody really knows EXACTLY what the impact is going to be but consensus is that the fallout will produce significant impact in the CPM and fill rate for ads. Developers are not going to have as much demand because the main value-add of extreme targeting within in-app advertising will be neutralized. Analysts have guessed that this change will cut user-targeted ads within apps by between 50% to 90%.

The burden shifts to the app developer for targeted advertising:

One of the big things that’s going to happen is the burden of establishing identity will shift from demand-side to supply-side in the industry. Developers are going to have to work at proving the identity of the audiences they’re supplying to their advertisers.

With IDFA there used to be an easy way to hand demand-side advertisers consumer information, easily packaged up by device and ready to go. The app publishers didn’t really need to have any expertise in how to segment their audience.

With these impending changes, that’s no longer possible.

User acquisition gets harder for developers:

Recent estimates show that 60% of downloads of apps with marketing spend in 2019 were driven by app install campaigns. One of the issues with IDFA’s demise is that attribution becomes more difficult, which makes it hard for developers to systematically manage growth for the apps that are using advertising to spur on downloads and installs. Many app publishers are themselves advertising customers, and they’re going to struggle to understand the channels that work best in getting app installs and growing their business.

How developers can prepare themselves

There’s no great answer to the coming IDFA paradigm shift, but that doesn’t mean that developers should just throw their hands up in despair. Now is the time to get as prepared as possible. We believe there are some critical strategies to think about in order to get ready for this launch.

Convincing users to opt-in

If a publisher frames it right, and most effectively knows how and when to ask for an IDFA opt-in, he or she may be able to improve the opt-in rate. According to research from eMarketer, some 70% of US consumers say they’re willing to share information such as location data if they get benefits such as saving money, discounts, or just making life more convenient. This indicates that with the right sales pitch, many consumers could be convinced to opt-in.

Based on early betas it looks like the opt-in menu from Apple is triggered when a developer invokes an API consent call. One strategy could be to delay triggering that call and in the interim, show a pre-pop-up within the app that appeals to the consumer and gives them more context about what providing this data will mean for the app. Some kind of message that says “Would you prefer we keep this product free for you with relevant ads,” could lead the consumer that clicks yes to more information on why they need to opt-in. At that point then the call is made and the consumer can make an informed choice.

Tap into other sources of user segmentation and audience data

Realistically, though, campaigns to increase IDFA opt-in rates will only prove so successful.

At the end of the day, app publishers must have mechanisms in place to provide some semblance of audience data to the demand side, and to help with user acquisition and engagement.

In the past, media properties used to do the work of understanding an audience and segmenting that audience for their advertisers. For example, an outdoor magazine would know amongst their large population that a certain percentage would be male, outdoor enthusiasts who like camping, and would provide those statistics to the demand side, who would place ads accordingly.

App publishers are going to need to find other audience data sources to adhere to this old-school advertising ethos. It may be the only way to survive in this new IDFA-free era. Many developers will struggle with this early on, especially smaller shops that have a gap in expertise about user segmentation and demographic analytics.

Rethink monetization

Developers that have been very reliant on in-app advertising may need to take Apple’s changes as an opportunity to update their business models, perhaps leaning into revenue sources that they’ve never tried out or which they haven’t committed fully to due to the income streams afforded by targeted in-app advertising.

This could mean coming up with new types of subscriptions or freemium benefits. It could also mean coming up with creative new micro-transactions or paid content. Whatever those choices are, it’s going to take more hustle and innovation for app publishers to maintain their profitability without IDFA-fueled advertising.

Maximize SKAdNetwork metadata

One bit of good news is that along with the IDFA restrictions, Apple is making improvements to its SKAdnetwork framework, which helps advertising apps and ad networks connect campaigns to installs. This is essentially Apple’s remaining replacement (though far from an equal source of data) for ad measurement and attribution data.

Developers will need to seek out methods and tools to maximize SKAdnetwork metadata so they can measure campaign performance.

Flurry is still here for you

The ultimate lesson we’re trying to communicate is that developers must prepare for a future where they cannot count on IDFA for easy user identification.

The good news is that Flurry Analytics is well positioned to help many developers and app publishers better survive the IDFA ‘apocalypse’. Flurry data sources have always helped developers manage their audiences and track demographic metrics crucial for understanding user behaviors. The ability to provide in-app user analytics is unaffected by Apple’s changes because the data collected is not tied to IDFA. Flurry tracks in-app user data based on the unique identifier for vendors (IDFV), which will not be impacted because it can’t be used directly for advertising.

Flurry can be leveraged by smart developers to pivot based on Apple’s changes.

At the end of the day, an advertiser will pay a premium for a very targeted, efficient ad campaign. IDFA provided that easily, but with some work, Flurry Analytics could help provide a viable alternative. The Flurry data stream may not provide information on the user specifically, but it will know that on that device, this consumer uses more games or reads more news. It’ll know where they are geographically within reason. And it can be used to make some important inferences about whether the activity is tied to a male or female, or which age group the user probably falls within. Armed with this kind of demographic, geographic, and behavioral signaling, developers can provide advertising customers with enough information to do at least some targeting, making it possible to regain ad monetization and performance lost by IDFA’s demise.

Additionally, the latest Flurry SDK includes a way to track something called Conversion Value Analytics, which offers signaling on the value of the user to the developer. This will greatly ameliorate attribution woes caused by these changes, providing analysis of post-install behavior that can provide valuable signaling to track install campaign performance.