March 24, 2015 | Simon Khalaf

In September of 1991, Ameritech, one of the “Baby Bells” serving the Midwest at the time,announced it would be offering its own credit card service to its customers. Back then, I was working for a networking company building messaging and directory services software for telcos and enterprises. Ameritech was one of our customers and I happened to be at their offices in Chicago when they held an executive town hall to discuss Ameritech’s entrance into the credit card business. One of my colleagues, who worked at Ameritech asked the question: “Why would a telecommunications company enter the retail banking business? What is our expertise in banking?”

The answer of the Ameritech executive has been imprinted in my brain the past 24 years. He said, in the response to my colleague’s question, “Banks have a currency called the US Dollar. Our currency is called Customer Loyalty.” He went on to explain that the company had reach, the addresses of their customers, and frequency (people make phone calls every day), but above all, they had customers who pay their bills, and that is what the retail banking industry needs.

Fast forward 24 years. In the past few months, Snapchat and Facebook Messenger have announced payments, the primary service of retail banks. Tencent’s WeChat extended its payment services into merchants and Xiaomi introduced an interest-bearing payments account. Slowly but surely, these apps are becoming the new face of retail banking, catering mainly to millennials, a segment highly receptive to changes to how they bank. In fact, a recent study by Goldman Sachsrevealed that 33% of millennials don’t think they will need a traditional bank in 5 years.

One might ask the same question raised above of the mobile messaging industry: “What do they know about banking?” But the analysis we are sharing today confirms that messaging apps today have the same currency telco companies enjoyed in 1991: customer loyalty.

Messaging Apps Rule in Retention

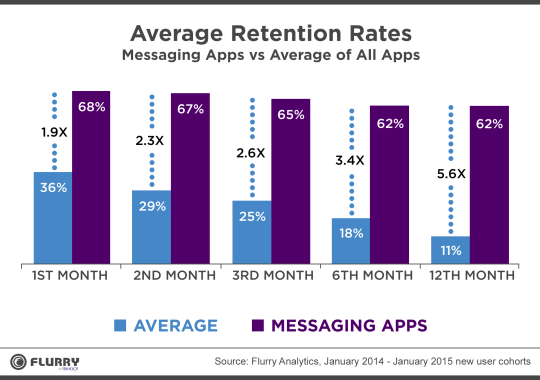

In our latest analysis, we found that retention rates of messaging apps out-performed the average of all apps. Messaging app retention is 1.9 times better than the average for one-month retention and 5.6 times better than the average for 12-month retention. The chart below shows the average retention of messaging apps compared with the the average retention of all apps over one month, two month, three months, six months and 12 months. Here we define retention as users who launched the app “n” months after install. The below chart considers new user cohorts from from January 2014 - January 2015.

The chart also shows the over-index of messaging apps compared to the average of all apps. It’s worth noting that the absolute retention rates are slightly lower this year compared to previous years, mainly because of the Apple iPhone base upgrading (in droves) to iPhone 6 and iPhone 6 Plus. But, since we are comparing apples to apples, the point is still valid. Messaging apps rule on retention.

Messaging Apps Rule in Frequency of Use

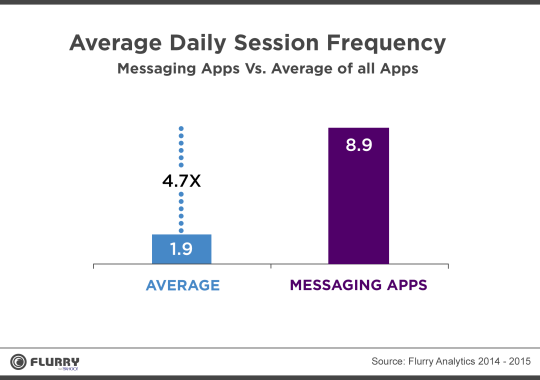

Ask any parent of a teenager and they’ll tell you that their kid is addicted to messaging apps. The chart below validates that. Messaging apps’ daily use is 4.7 times higher than the average app. The average daily use of an app across all categories is 1.9 times. Messaging apps are used, on average, almost 9 times every day. By definition, communications apps are chatty. Add to that the convenience of the smartphone device and the fact that it is glued to your body, and you get the multiplying effect making messaging apps rule on session frequency as well.

The combination of solid retention and off-the charts frequency of use give messaging the same currency telco companies enjoyed: customer loyalty.

Messaging As the Platform

Research we released in early 2014 suggested last year would be a crucial year for messaging apps that would determine whether they would remain independent, yet highly frequented applications, or become a platform for other mobile services. At that time, the jury was still out. Now, a little more than a year later, it is safe to say that messaging apps have made the leap to become the platform for many services, starting with payments and most likely ending with commerce. Last week, TechCrunch’s Josh Constine published a post suggesting Facebook plans to turn Messenger into a platform. While I believe (and always enjoy) Josh’s scoops, it’s clear to me that messaging is already the platform of mobile and customer loyalty is its most valuable currency.